Close

With the sharp drop in the crypto market, $55 billion has been withdrawn from the market in the past month. As Bitfinex liquidity decreased, outflows from the crypto market reached $55 billion in August. Crypto liquidity crisis can affect price fluctuations. In this Pooyanmusic post, we will talk about the withdrawal of 55 billion dollars of capital from crypto in August.

According to a recent Bitfinex analysis, the crypto liquidity crisis could allow event-driven volatility to have a greater impact on prices.

Capital outflows in the crypto industry reached $55 billion in August, according to a report published by the Bitfinex exchange.

The analysis is based on the Total Realized Value metric, which measures the realized capital of Bitcoin and Ethereum alongside the top five stablecoins. These 5 stablecoins are Tether, USDC, BUSB, Dai and TUSD.

According to the report, “a deep dive into the data reveals a dominant trend. In early August, the industry began to experience capital outflows.

According to this measure, during the last month, about 55 billion dollars have been withdrawn from the digital currency markets. Capital outflows affected not only Bitcoin but also the liquidity of Ether and stablecoins. Bitfinex said:

August was the biggest monthly red candle for Bitfinex since the bear market bottom formed in November 2022 at -11.29%, according to Bitfinex data.

The impact of sudden events on the crypto market depends on what factors?

This analysis also points to the return of so-called event-driven volatility. where individual events can have a greater impact on overall market prices and movements. In August, two separate events had a significant impact on the price of Bitcoin. On August 17th, a quick crash resulted in a selloff of more than 11.4% for BTC. Similarly, Grayscale’s partial legal victory over the Securities and Exchange Commission on August 29 led to a 7.6% price jump in two hours.

“Volatility benchmarks remain low,” Bitfinex said. But the liquidity crisis in the market causes more impact of various events on the market movements.

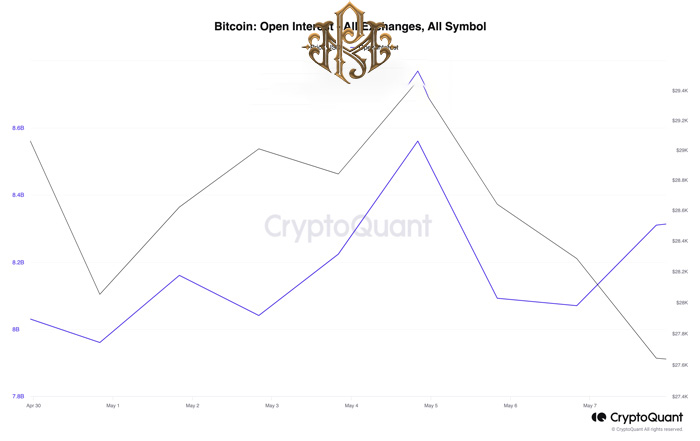

According to this analysis, Bitcoin open interest has outperformed crypto markets due to increased institutional interest and money laundering business at some exchanges. Ether futures and options trading in 2023 has decreased significantly compared to previous years and reached $14.3 billion per day. A statistic that has a sharp decrease of almost 50% compared to the two-year average.

The open interest of a particular contract, such as Bitcoin futures or options, shows the total number of open positions. A measure that shows the amount of investment in Bitcoin derivatives.

“The trajectory seen in the derivatives market, particularly in renewed interest in both futures and options, reflects these patterns of low liquidity,” Bitfinex wrote.