Close

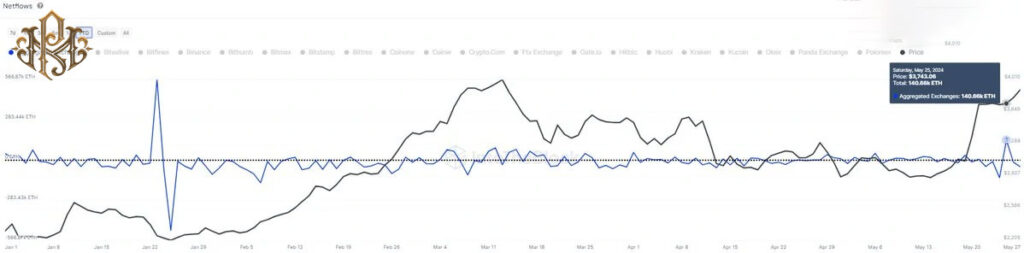

Despite the price of ETH falling below $3.9K, record-breaking inflows of ETH to exchanges have pushed ETH turnover to the highest level this year. Fear or profit? Ethereum inflows to exchanges increased to 140.66 thousand ETH, the highest since January.

Ethereum has been hovering near the $4,000 mark, fueled by a major U-turn in the US Securities and Exchange Commission’s (SEC) decision to approve Ethereum spot ETFs. This development has increased traders’ optimism about the price path of this leading altcoin.

However, the increased inflow of ETH to cryptocurrency exchanges could cause problems.

Ethereum is up almost 20% in the last month. Its resurgence in performance has been largely driven by market expectations for the recognition of Ethereum ETFs in the US.

The price action of this asset was very weak immediately after the ETH confirmation. But in the end, the move towards the $4000 mark was considered very important and significant.

The volume of ethereum entered into the exchanges reached its peak since January. This included a net inflow of 140.66K Ethereum on May 26, marking the highest net deposit in over four months.

Such significant inflows to exchanges usually indicate selling activity, according to data compiled by IntoDilac. Because people aim to secure profits or react to fear, uncertainty and doubt (FUD).

With the recent price rally, LukeAnchain observed that a “smart money” investor recently sold 3,025 ETH for 11.8 million DAI at an ETH price of $3,904, resulting in a profit of approximately $1.11 million.

In addition, this investor had accumulated 17,770 ETH between 2017 and 2020 at an average cost of $182 per ETH. On March 28, 2024, they sold this ETH at $3,503 per token, making a profit of around $59 million.

Another interesting activity by an Ethereum whale was noticed by the platform, which recently withdrew 2,856 ETH worth $11 million from Kraken. The whale previously collected 35,176 ETH from the same exchange at an average price of $428 per ETH between October 2018 and November 2022.

On October 20, 2023, Whale returned all of this Ethereum to Kraken. When it was priced at $1,610 per Ethereum, it made a profit of approximately $41.6 million. However, the sale was delayed shortly after due to the growth of the crypto market. If the whale had kept their ETH, their profit would now be around $122 million.