Close

The top 8 digital currency exchanges control 90% of the market liquidity. Despite creating a financial market that has thrived on narratives of decentralization, the cryptocurrency industry’s liquidity is largely concentrated among a few centralized exchanges (CEX). In this Pooyanmusic post, we read about the reasons for the success of these exchanges.

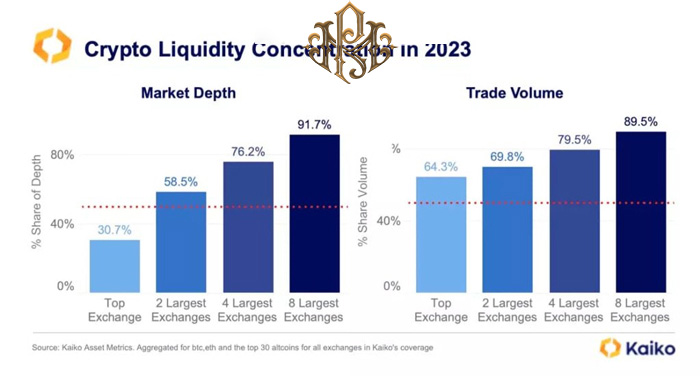

In 2023, 91.7% of the total liquidity of the crypto market is in the hands of only eight global institutions: Binance, Coinbase, Kraken, OKX, Kocoin, ByteBit, Binance America and Bitfinex. This is what a new report from Bankless Times on September 15 pointed out.

Interestingly, Keiko’s smart data platform also recently reported a similar value of 91.7% of total centralized liquidity among eight centralized exchanges. 58.5% of this liquidity is kept by two exchanges. Things get worse when we look at the volume of transactions. 64% is dominated by a CEX.

It is noteworthy that the crypto market liquidity and trading volume have become more concentrated since 2021. Because until then, the dominant CEX had only 38% of the total trading volume. And the current 65 percent was done on four large entities instead of one.

This reflects a worrying trend of centralization over the past two years, rather than what is expected to be an increasing decentralization to the space built in these values.

Liquidity concentration is a double-edged sword

Liquidity concentration is a double-edged sword. It can offer great benefits, but it also comes with significant risks. “The crypto community needs to find ways to deal with its risks without losing those benefits.”

– Alice Latham, digital currency expert at Bankless Time

According to Bankless Time, this tendency to “dominate” occurs because these exchanges had “first mover advantage”. They have earned the trust of users over the years, and also list a higher variety of cryptocurrency pairs with good liquidity. Not only that, but they can also invest in better technology for more reliable service.

Furthermore, the more liquidity CEX has, the more liquidity it will attract. Because traders and investors usually look for liquidity and trading volume when choosing their services.

However, it also creates a riskier environment than dependence on these dominant institutions. These cases have been called “concentrated vulnerability” by experts. These cases consist of single breakpoints. If negative events occur in these boundaries, it can affect the entire space.