Close

Bitcoin is the best cryptocurrency, says Fidelity’s Digital Assets Report. But why is Bitcoin different from others? In this Pooyan Music post, we examine Fidelity’s report on Bitcoin’s advantage over other currencies.

A new report from Fidelity Digital Asset argues that Bitcoin is fundamentally different from other digital assets. Therefore, digital currency should be evaluated separately when building an investment portfolio.

Fidelity Digital Asset highlights the distinctive value and valuation of Bitcoin in crypto portfolios.

The world’s third-largest asset management system is strongly bullish on BTC, with discretionary assets under management (AUM) of a staggering $4.24 trillion. Its affiliate, Fidelity Digital Assets (FDA), is wholeheartedly committed to the cryptocurrency-based investment space.

The latest FDA research report shows that projects beyond Bitcoin warrant a unique assessment of Bitcoin itself. “Investors should have two distinct frameworks for considering investing in this digital asset ecosystem,” said report authors Chris Kuiper and Jack Neuter.

The report authors add:

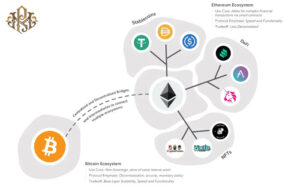

The first framework examines the inclusion of Bitcoin as an emerging monetary commodity. And the second framework considers the addition of other digital assets that represent venture capital assets.

According to the report, Bitcoin is best known as a scarce monetary asset whose primary value is a store of value. Unlike other digital assets, Bitcoin was first and foremost designed to solve the problem of digital scarcity and create a form of censorship-resistant digital money.

The report argues that no other blockchain is likely to overtake Bitcoin as a monetary commodity. Because any change requires a trade-off in decentralization or security. “Bitcoin is currently the most secure and decentralized monetary network,” the authors say. “So this eliminates other networks that are competing for different use cases other than money.”

According to this report, Bitcoin benefits from powerful network effects that make it a global currency. Its history of surviving threats and attacks has also made it stronger through a phenomenon called the Lindy effect.

“Bitcoin’s return profile is driven by two strong currents: the global growth of the broader digital asset ecosystem and the potential volatility of traditional macroeconomic conditions,” Kuiper and Norreiter write. This return is associated with less risk compared to other crypto assets.

In contrast, non-Bitcoin digital assets represent higher risks and have higher returns similar to investment investments. According to the report: “Allocating to non-Bitcoin tokens is often done with a venture capital-like mindset.

Given Bitcoin’s distinct risk and return profile, the report concludes that crypto investors should consider Bitcoin separately as an asset before considering other higher-risk, higher-return digital assets to complement their portfolios. Evaluate money.