Close

The third year of the legal conflict between the United States Securities and Exchange Commission (SEC) and cryptocurrency company Ripple may be coming to a conclusion.

Ripple and the SEC, along with other interested parties, have in fact since submitted summary briefings that are likely to affect the case’s result after both sides completed their last filings.

Defense lawyer James Filan said that Ripple has filed a petition challenging a move by Investment Banker Declarant trying to keep some facts from the public until the final briefings.

His name, position, and employer are among the details. The declarant argues that since he freely provided the declaration supporting the SEC’s move for summary judgment, he ought to be given protection.

Finbold had previously reported that Investment Banker Declarant, a non-party to the litigation, had filed a petition to redact a prior declaration supporting the regulator’s request for summary judgment.

Given that the matter has given rise to a bitter dispute between the interested parties, certain grounds of disagreement will arise while the community waits for the ultimate decision on which papers the court may decide to seal. It will also be interesting to see if the parties can come to an agreement following the judgment in order to stop any future appeals.

The development has rekindled discussion about the potential result now that the case has been fully briefed. It is noteworthy that both sides profess confidence in winning.

However, according to American attorney John Deaton, a definitive decision cannot be expected solely on the arguments offered in court. In a tweet on January 20, Deaton reminded the crypto community that they can pick up a clue on what to anticipate from the SEC’s handling of the matter in reaction to internet rumors that the case would go the SEC’s way.

“I hear all these XRP haters say the case is so simple and easy for the SEC and that XRP is clearly a security, but no one has an answer. If XRP was so clearly a security, why didn’t the SEC order Ripple to stop selling it after SEC enforcement lawyers analyzed it in June 2018?” he posed.

Notably, the SEC is suing Ripple for selling unregistered securities in the form of XRP coins without abiding by the rules established by the agency. Though Ripple CEO Brad Garlinghouse said that the matter would be resolved in the first half of 2023, there is still discussion over the potential judgment date at this time.

It is obvious that how this case turns out will have a big impact on the cryptocurrency sector. Stuart Alderoty, general counsel of Ripple, forewarned that the decision may have a significant effect on the American digital asset market.

While waiting for the matter to be resolved, Ripple expressed confidence that it handled everything correctly. As a result, the corporation continues to be dedicated to growing its primary business outside of the United States.

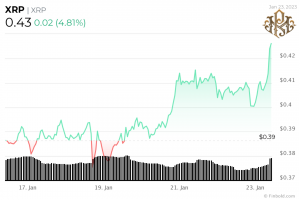

The case development is anticipated to have a substantial effect on the price of XRP, which has received some optimistic signals as a result of the situation. At the time of publication, the coin had daily gains of more than 4% and a value of $0.43.