Close

To establish a positive reputation, Litecoin [LTC] utilized its bull run during the press time period. It was allegedly an attempt to steal some of Bitcoin’s [BTC] sparkle. On January 21, LTC mentioned five characteristics that made it desirable and distinguished it from its rivals in a tweet.

The fact that Litecoin was four times quicker than BTC was a significant feature. While making such a claim would seem like a ploy to make LTC look more appealing than Bitcoin, it does not necessarily disadvantage the rivalry.

The two cryptocurrencies have, if anything, coexisted in the same market, and neither one represents a danger to the other. Although Litecoin has so far produced a remarkable climb, is it truly a superior choice for this bull run?

Looking at Litecoin’s price movement, was up around 51% from its lowest 12-month level in June 2022 at the time of writing. Bitcoin, on the other hand, has increased by 47% since its November 2022 lows. The price of the former has been rising throughout trade. At the next climbing resistance level, a sustained upward movement should at least take it beyond $100.

Prior to touching the rising resistance line, the price had some space at the time of publication. Another observation hinted to the possibility that the price may begin to fall under the weight of the sell push. It recently surpassed the previous high set on January 14 to hit a new nine-month high.

Meanwhile, there has been considerable slippage in the RSI and MFI, which suggests trend weakening. This discovery of a price-RSI divergence frequently indicated an impending negative move. According to LTC’s supply distribution, some of the biggest and most powerful whales were already on the market at the time of writing.

The majority of LTC’s supply is now held by addresses with between 100,000 and 1,000,000 coins. For the past three days, the same address category has been adding to the sell pressure.

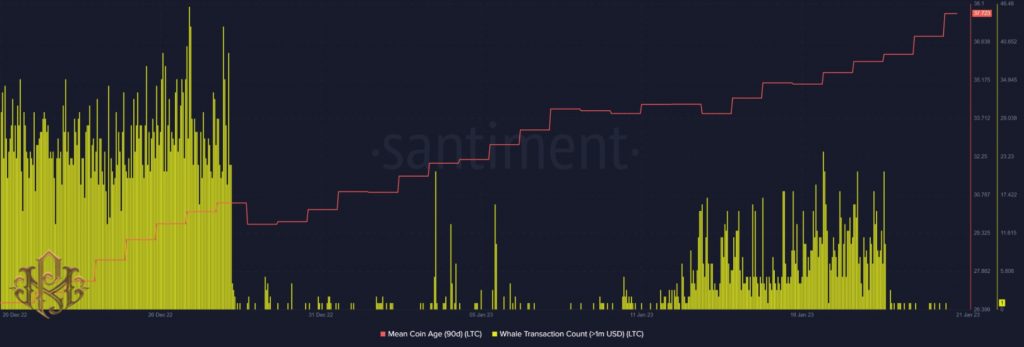

Despite this, there is currently no sell pressure as seen by the low whale transaction count. The average coin age indicator has likewise maintained an upward trend, indicating that investors are continuing to hold onto their LTC tokens.

When Litecoin’s price and RSI diverged previously, there was a pullback in the days that followed. In the upcoming days, it may occur once again. Investors must remember that despite overbought conditions, the market dynamics were still in favor of the bulls at the time of publication.