Close

There are indications that the retail trading surge of the previous year is slowing down. In the first two years of the Covid-19 pandemic, retail traders had a significant effect on the stock market; today they are suffering significant losses.

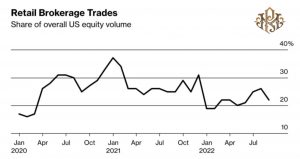

JPMorgan Chase & Co. estimates that in 2022, returns for retail trading will fall by around 40%. Since the beginning of 2021, the proportion of these investors in US equities market volumes has likewise decreased by 40%. High-flying technology companies are no longer as popular as they once were; this year, the ARK Innovation exchange-traded fund has fallen 63%.

Although there has been a decline in retail trading activity in traditional stock markets, it is yet unclear if this trend is present in the cryptocurrency market.

Numerous small-business owners have run out of money, maxed up their credit cards, and are without savings or government assistance.

With central banks boosting interest rates and the cheap money that fuelled markets for more than a decade drying up, market circumstances have altered. Meme stocks like Bed Bath & Beyond and GameStop, which were prominent in 2021, are currently suffering double-digit losses. The free software used by many retail traders, Robinhood Markets, has also experienced a 75% decline in the value of its own shares.

How does this affect the cryptocurrency market, though? Retail investors, who have rushed to digital assets as a way to diversify their portfolios and take advantage of the high returns they provide, have contributed to the ascent of cryptocurrencies. However, some retail traders are concerned following the recent decline in the cryptocurrency market, which saw numerous cryptocurrencies lose over 50% of their value in a matter of days.

The promise of quick earnings and the possibility for long-term gains have kept new traders and investors interested in the cryptocurrency market despite these ups and downs. More people than ever may now engage in the cryptocurrency market because to the growth of decentralized exchanges, non-custodial wallets, and other cutting-edge financial instruments.

Therefore, has the cult of the retail trader also lost steam in the cryptocurrency market? The response is a little more nuanced than a straightforward yes or no.

There are now fewer new retail traders joining the cryptocurrency market. There are several reasons for this transition.

For starters, the market has grown more unpredictable and complex since it has been more challenging for individual traders to consistently generate profits due to rising interest rates and more regulatory scrutiny. Furthermore, a lot of traders have come to the realization that the large stakes and frenetic trading that defined the boom were unsustainable and may end in substantial losses.

With a sizable and devoted community of individual crypto traders and investors, the market is still active and dynamic. Since the cryptocurrency market is distinct in many respects, it is challenging to generalize about how retail traders would behave in this market.

The market for cryptocurrencies is still in its infancy and is expected to continue to expand and mature over the next few years.

It’s critical to keep in mind that the cryptocurrency market is its own beast with its own set of laws and characteristics, even while the decrease in retail trading activity seen in traditional markets may to some extent be replicated there. Retail trading in this market may change in the future, but one thing is certain: individual traders’ and investors’ choices will continue to influence the crypto market.