Close

From its low point in December, the Shiba Inu price has increased by 50%, and its daily trade volume has increased to $300 million.

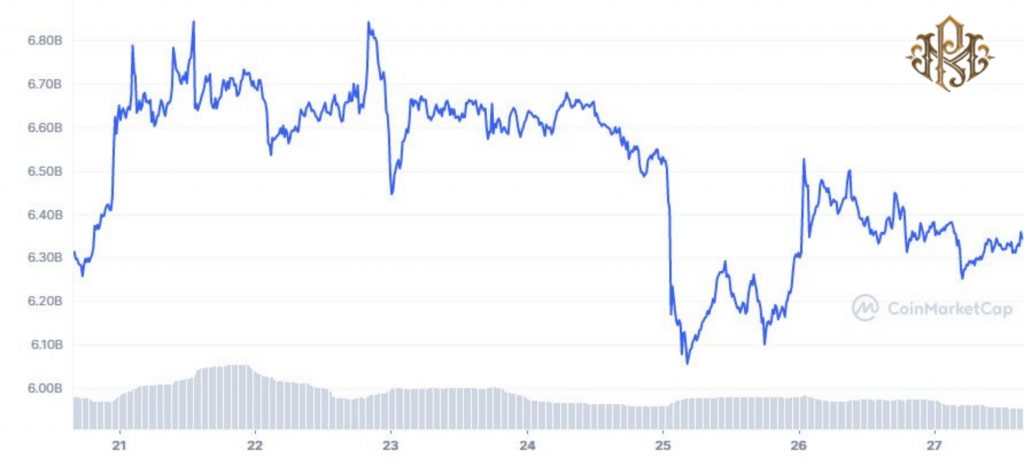

SHIB’s market valuation, which is currently $6.8 billion, reflects the stock’s volume and price increase. After displacing Litecoin, the meme coin is currently the 13th biggest cryptocurrency. Although 589 billion Shiba Inu tokens are available, only 549 trillion are presently in use. For staking reasons, other SHIB coins have been secured in smart contracts.

Large-volume cryptocurrency investors have traditionally flocked to Shina Inu, notably Ethereum whales. Shiba Inu is one of the top 10 smart contracts that the top 1,000 giant Ethereum whales utilized on Friday, according to WhaleStats.

Shiba Inu is among the most often utilized smart contracts for the top 100 Ethereum whales in 24 hours, ratcheting up the drama. Along with SHIB, there is Biconomy(BICO), Maker(MKR), Decentraland(MANA), and Numeraire (NMR).

Other news includes the massive transfer of SHIB tokens by a wealthy whale, presumably in advance of the introduction of the new protocol, Shibarium. According to data made public by Whale Alert, a program that tracks whale transactions in the cryptocurrency market, the investor moved well over 3 trillion SHIB, which was worth around $38 million at the time of writing. The transfer came from one unidentified wallet and nonetheless ended up in another.

It’s interesting to note that according to statistics from Etherscan, the wallet got about the same number of tokens from an anonymous wallet two weeks ago when its balance was zero.

The daily time frame chart shows that the Shiba Inu price is moving within the confines of a falling trend channel. The 200-day Exponential Moving Average (EMA) (in purple) has capped movement at $0.00001181 after SHIB was rejected from January highs at $0.00001149. The token has now fallen to trade at $0.00001149.

Although this correction may be momentary, the Moving Average Convergence Divergence (MACD) indicator’s technical outlook is gloomy. The optimal time to enter short bets on the Shiba Inu price is when the blue MACD line crosses below the red signal line, indicating a sell signal.

Shiba Inu may be forced to seek safety below the trend channel’s lower boundary support or, if you’d prefer, the buyer congestion at $0.00001 if falls continue unabated over the weekend.

On the other hand, traders may easily keep onto their long positions depending on the 50-day EMA passing over the 100-day EMA (shown in red). Although this pattern is not a perfect golden cross (a golden cross is when the 50-day EMA crosses above the 200-day EMA), it indicates that Shiba Inu’s upward momentum is in place and can remain in position in the upcoming sessions, maybe for days.

Therefore, to overcome the 200-day EMA and the upper limit of the trend channel, bulls need to give Shiba Inu price a slight boost. Recognize that a clear break and hold above this pattern on the chart would open the door to gains aiming for the October high of $0.00001520 for SHIB and the November top of $0.000018 for Shiba Inu.

By emphasizing a strong buyer congestion zone at $0.000011, the IOMAP model from IntoTheBlock supports the bullish story above. Nearly 20.5k addresses in this area that bought 100.6 trillion SHIB would support an increase in the price of Shiba Inu.

Unrealized profits comprise at least 137.37 trillion SHIB tokens or 69.65% of the protocol’s entire supply. Out-of-the-money tokens (unrealized loss) make up about 27.15 percent of the total supply, or around 53.54 trillion SHIB. At the breakeven point, there are 6.32 trillion tokens available, or 3.20% of the total supply.

According to the statistics above, there are more SHIB tokens with unrealized profit than unrealized loss or break-even points combined. This demonstrates that investors would choose to support a Shiba Inu price increase than sell the token, particularly with the upcoming introduction of the Shibarium protocol.

Shiba Inu’s online community, the ShibArmy, is jubilant about Atomic Wallet’s announcement of early support. With this act of kindness from Atomic Wallet, the new protocol would be available to more than 3 million users worldwide.

The community has been asked to stop asking when the launch will be, but then, the finish line is nigh. The core developers of the Shiba Inu ecosystem assured investors on January 16 that the Shibarium beta “is about to be launched.” Still, the team insisted that it focuses on building the Layer 2 protocol “correctly and introducing it responsibly.”

A robust layer two blockchain called Shibarium is intended to transform the Shiba Ecosystem. Its primary objective is to grow Shiba Inu transactions while maintaining security and decentralization.

The layer two protocol keeps its connection to the Ethereum blockchain, which is utilized by all of the ecosystem’s tokens, including SHIB, LEASH, and BONE. Scalability and quicker transaction times are advantages offered by layer two blockchains like Shibarium and Polygon while charge rates are kept low.

Shiba Inu’s price is anticipated to increase as a result of the debut of Shibarium, which reached an all-time high of $0.00008616. It is still being determined when it will launch, but investors anticipate it will happen in the first quarter of 2023.