Close

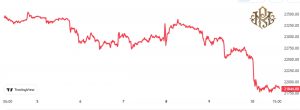

According to data, today’s market mood for Bitcoin has been neutral as a result of the asset’s price falling below the $22,000 barrier.

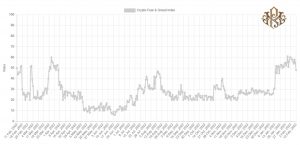

An indicator that provides information about investor attitude in the Bitcoin market is the “fear and greed index.” The sentiment is shown using a numeric scale in the measure that ranges from 0-100.

All readings over the 50-point threshold signal that the market is now greedy, while readings below it imply that investors are scared. The border values between 46 and 54 are actually handled as a “neutral” attitude in reality, despite the fact that this divide may be clear in principle.

Additionally, there are two other distinct emotions known as “extreme greed” and “extreme fear.” These occur when the index is more than 75 and less than 25, respectively.

The relevance of the strong feelings comes from the historical tendency of Bitcoin price peaks and troughs to coincide with such mentalities. For this reason, some traders think that the greatest times to purchase are when there is tremendous fear (when bottoms form), and the best times to sell are when there is extreme greed (when peaks occur).

The current value of the Bitcoin fear and greed index, 48, as seen above, indicates that investors’ attitudes are neutral with a little bias toward dread.

Compared to prior days when the market had been greedy, this represents a decline in value. The indicator’s value change over the previous year is depicted in the chart below.

The graph shows that the Bitcoin fear and greed index has been at severe dread and terror levels for most of the previous year. These fear and high terror streaks really lasted the longest amount of time in the indicator’s history.

Earlier this year, when the price of Bitcoin finally rose and investor sentiment left the fearful territory, the run ultimately came to an end. The mindset was first simply neutral, but as the rise progressed, holders eventually began to embrace the bullish trend and become greedy.

The measure has once more returned to a neutral value today as a result of the most recent fall in BTC, which has sent the price of the currency below $22,000 after spending a few days in the greed zone.

At this moment, it’s unclear if the change in attitude is only passing or if it represents a return of investor skepticism over the sustainability of the advance, in which case the index may soon enter the fear zone.

At the time of writing, the price of Bitcoin is about $21,800, a 7% weekly decline.