Close

Bitcoin returned to the range of 71 thousand dollars. Coinbase Premium Account shows a green uptrend on the Bitcoin price chart.

The price of Bitcoin increased to above the level of 71,000 dollars during the last day. Because it looks like buyers are back on Coinbase.

Bitcoin Coinbase Premium has seen a huge positive jump.

Coinbase’s BTC premium index has recently hit a record high, according to Pooyan Music report. “Coinbase Premium Index” refers to an index that tracks the percentage difference between the price of Bitcoin listed on Coinbase (USD pair) and Binance (USDT pair).

When the value of this metric is positive, it means that the price of the cryptocurrency listed on Coinbase is higher than that of Binance at the moment. Such a trend indicates the presence of higher buying pressure (or just less selling pressure) in the first stock market compared to the second one.

On the other hand, the indicator’s negativity suggests that there may be more selling in Coinbase than Binance right now, pushing the former’s price to a lower value.

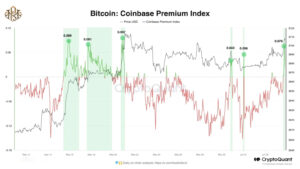

Now there’s a chart showing the trend of the Coinbase Bitcoin Premium Index over the past few weeks:

As shown in the chart above, the Coinbase Bitcoin Premium Index has been mostly in the negative for the past two weeks. Prior to this red line, the metric had seen a phase of positive levels. Interestingly, the price of cryptocurrency increased along with these green values. This means that buying pressure on Coinbase may have helped fuel the rally.

Coinbase is known to many as the preferred platform for US-based institutional entities, while Binance hosts more global traffic. In this way, the value of this index can provide hints about the difference in the behavior of these American whales from other parts of the world.

This year, these institutional investors took center stage in the Bitcoin market with the approval of exchange-traded funds (ETFs). Their movements were reflected in the price of Bitcoin. The previous pattern of potential buying pressure from these large US investors leading the rally is just one example of this trend seen at different times of the year.

As mentioned earlier, what has followed this rally has been the negative values of the Coinbase Premium Index over the past two weeks or so. While this selling pressure has not caused any significant downward effect on Bitcoin. The coin has not yet been able to make a further upward movement.

Maybe a glimmer of hope has appeared in the past day. Because this indicator has registered a big positive jump. It is currently unclear whether this will lead to another buying streak like last month or if it is just a temporary blip like the two short-term gains we saw earlier last week.

In any case, Bitcoin has been able to enjoy some upward momentum over the past 24 hours, likely at least in part due to this buying pressure.

In this new increase, Bitcoin has so far been able to climb to the level of $71,300. Now it remains to be seen how long this trend can continue.