Close

Are the halving problems over now? Because Bitcoin’s hashrate broke its all-time record.

On-chain data shows that Bitcoin mining hashrate has rebounded sharply from its post-halving lows. Hash rate has now reached an all-time high (ATH).

The 7-day average of Bitcoin Mining Hash Rate has just set a new ATH.

According to the digital currency website, the Bitcoin network is based on a consensus mechanism called “Proof of Work” (PoW). In this system, validators called miners compete with each other using computing power for the chance to add the next block to the blockchain.

“Hash Rate Mining” refers to a measure of the total computing power that miners currently have connected to the network for this purpose.

When the value of this metric rises, it means that either outgoing miners are expanding their facilities or new miners have joined the chain. Such a trend suggests that these lenders find the network attractive now.

On the other hand, the descending indicator shows that some miners have decided to disconnect from the network. Probably because they consider the chain useless and unprofitable for mining.

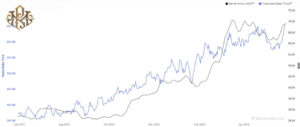

Now, here’s a chart showing the average 7-day Bitcoin mining hashrate trend over the past year:

As shown in the chart above, the average Bitcoin mining hash rate has started to decline in the 7 days after setting a new ATH last month. The decline intensified in the first weeks of the month, pushing the metric to much lower levels.

This sharp downward trend in the indicator is due to an important event in the network in the last month: the fourth halving. The halvings are periodic events that occur every four years. In the process, the BTC block reward is permanently halved.

The block rewards that miners receive for solving blocks on the network are one of the two main components of their income. Another part of their income, transaction fees, has historically been very small compared to block rewards, so the latter has essentially been their main source of income.

As such, it is not surprising that some miners live in areas with high electricity prices. They use inefficient mining rigs, disconnect when the economic effects of halving begin.

But then a question arises: if there have already been three halving events in the history of the asset, how can the hashrate continue to be at its highest level if the miner’s income continuously decreases?

Two factors explain this. The first is that mining rigs have become more efficient over the years, allowing miners to host more power while consuming less energy.

Another and perhaps more important thing is that the price of Bitcoin has generally been rising throughout its history. While block rewards remain fixed in bitcoin value until the halving ends, their dollar value still naturally fluctuates with the cash price.

Time and time again, price growth has helped offset miners’ lost income from halving. Recently, the price has improved a bit and as can be seen in the hash chart, the metric has also turned positive along with it.

It seems that the miners were satisfied enough with this increase in income from the rally that they took their computing power to a whole new ATH. Having said that, it is quite clear why Bitcoin hashrate broke its all-time record.

At the time of writing, Bitcoin is trading at around $68,000, down more than 3% in the past week.