Close

As evidenced by statistics showing that the link between Bitcoin and Gold has increased recently, the idea that Bitcoin is a safe haven asset may be returning.

The connection between the two assets remained high during the current US financial crisis, according to Glassnode’s most recent weekly analysis. The degree to which Bitcoin is closely tracking changes in the price of a troy ounce of gold is shown by its “BTC correlation to Gold” value.

When the value of this indicator is negative, BTC is now moving against the direction of changes in the price of gold. Positive readings of the indicator, on the other hand, signal that the two assets are now advancing in a comparable direction.

Naturally, when the correlation is 0, it means there is no pattern in the movement of Gold and cryptocurrencies in relation to one another.

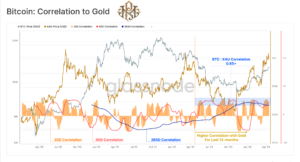

Here is a graph that displays the 30-day Bitcoin connection to Gold trend during the past five years, along with its 90-day and 365-day iterations:

As can be seen from the graph, the measure had assumed negative values for a sizable portion of the period, therefore there wasn’t much of a strong positive association between Bitcoin and Gold throughout the bull run in 2021.

In the first few months of 2022, the correlation was likewise modest, but as the bear market started to take hold, things started to alter. The indicator has primarily recorded high positive values over the past twelve months, indicating that during this time the two assets have grown very tightly correlated.

One exception, though, was the FTX crash, since the indicator’s value had changed to a dark red color right before it happened. However, this year’s surge rapidly returned the assets to a strong correlation as all three moving averages (MAs) (30-day, 90-day, and 365-day) attained positive values.

Stocks and bitcoin have always been viewed as hazardous investments, whereas gold has long been seen as a safe haven asset. The idea of “Digital Gold” appears to be resurfacing now that there is a strong link between Bitcoin and Gold.

It’s interesting to note that the link persisted during the recent US financial crisis, when organizations like Silicon Valley Bank (SVB) failed and the market was shaken. This might be another proof that recent perceptions of BTC have improved.

“This does suggest that an appreciation for both sound money and the realities of counter-party risk are increasingly front of mind for investors,” notes Glassnode.

Bitcoin is currently worth roughly $29,500, up 1% over the past week.