Close

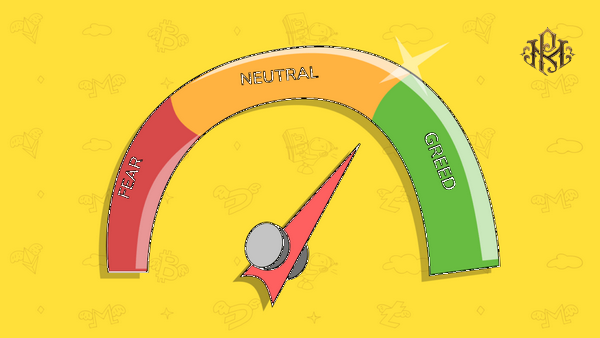

Fear and Greed Index (Fear and Greed Index) is used in cryptocurrency markets to give a look at the possible trend of investor behavior in the cryptocurrency market. This indicator is an analytical tool that attempts to display the general mood of the market and provides an understanding of the emotional state of investors in relation to the prices of cryptocurrencies.

The fear and greed index is calculated based on various factors such as trading volume, price change, media attention, technical analysis and many other factors. This index is produced based on a special algorithm developed by a team of analysts and market experts.

The fear and greed index is usually displayed as a number between 0 and 100. A value of 0 indicates a state of fear and panic in the market, while a value of 100 indicates a state of greed and rising prices. This index is used to help investors in their decisions about cryptocurrencies and to understand the market trend.

As a market psychology tool, the fear and greed scale can help investors identify the best time to buy and sell cryptocurrencies. In a state of fear, the market may react irrationally and hastily, while in a state of greed, the market may overbought. By analyzing the fear and greed index, investors can take advantage of the market trend and make significant investment decisions.

However, it should be noted that the fear and greed index is only one of the factors used in the analysis of the behavior of the market and investors, and for optimal decisions, more detailed analyzes and access to more complete information should be used.

Crypto Fear and Greed Index is a popular index used in cryptocurrency markets. This indicator analyzes the behavioral theory of investors in cryptocurrency markets and is used as a psychological tool to examine market trends and investor decisions.

The crypto fear and greed index is produced based on various factors such as trading volume, daily price changes, technical analysis, social networks and news. This index is calculated based on an algorithm in which different factors are weighted and the final result is displayed on a scale of 0 to 100.

A value of 0 in the crypto fear and greed index indicates a state of fear and panic in the market, while a value of 100 indicates a state of greed and rising prices. This index is updated daily and is produced based on the results collected from various sources and market analysis.

The Crypto Fear and Greed Index helps investors understand the general mood of the market and make more confident decisions about buying and selling cryptocurrencies. By observing this index, investors can have a more accurate understanding of the concerns and hopes of the market and make better decisions about their transactions based on it.

Also, according to this index, it is possible to predict the trend of greed and fear in the market and consider a certain percentage of risk in investments. However, it should be noted that the crypto fear and greed index is only one of the factors used in market analysis and investment in the cryptocurrency market.

Crypto Fear and Greed Index

The fear and greed index is an important concept in Benoy crypto markets, which shows the psychological and emotional behavior of investors. Fear and greed in financial markets are generally recognized as two important forces in investor decision-making.

Fear means the feeling of concern and doubt about the fall in the value of investments. When markets become unstable or prices drop suddenly, fear sets in and investors may sell off. This situation usually leads to a drop in prices and a decrease in investment returns.

Greed means wanting more. When markets are doing well and prices are rising, investors may experience excessive greed and seek more profit in the shortest possible time. This situation usually leads to extreme price fluctuations and even creating a sales disaster or a price hole.

To be successful in the crypto market, it is important that investors have the ability to control and manage their fear and greed. This means having proper financial planning, doing accurate analysis and having balanced investment approaches. Also, a deep understanding of the nature of the emerging crypto markets and risk tolerance is also important.

In short, fear and greed are two strong forces in the crypto market that can positively or negatively affect investment trends. Controlling these two factors and drawing a precise and balanced investment approach can help investors to sustainably exploit the Benoy crypto market.