Close

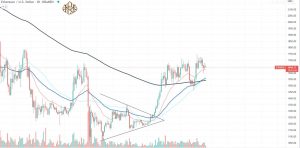

As it has been unable to move over this price level, traders have been worried about Ethereum (ETH), which has been trading around the $1,600–1,750 region. The recent emergence of a “Head and Shoulders” pattern, which is seen as a bearish reversal pattern, adds to this.

The uptrend is represented by the left shoulder at its beginning, the head at its top, and the right shoulder at its conclusion. A bearish reversal is indicated if the price moves below the neckline, which is determined by connecting the lows of the two shoulders.

For some time now, ETH has been unable to overcome the $1,600–$1,750 resistance level. A bearish reversal from the recent high may be indicated by the Head and Shoulders pattern that has developed. Before making any trading moves, traders should exercise caution and wait for confirmation of the pattern.

Around 61,000 ETH were burned in the first 24 hours following the deployment of Ethereum Improvement Proposal (EIP) 1559, indicating that the burn rate for Ethereum is dramatically increasing in the meanwhile. By adding a system that adjusts costs based on network demand, this proposal seeks to increase the predictability of transaction fees on the Ethereum network. Many traders are still concerned about the Ethereum ecosystem’s lack of basic growth factors, though.

XRP is the fourth-largest cryptocurrency, but its performance has been dreadful recently. Although there are times of high volatility in the cryptocurrency market, XRP’s performance over the past several months has been very constant, which has made some investors worry if it has lost its appeal.

Despite the absence of volatility, a number of factors point to the possibility of a price increase for XRP in the near future. The owners of XRP may not necessarily benefit from this surge, though. This is due to the fact that XRP has been trading in an ascending channel, which implies that its highs and lows have been becoming higher. Although this is a positive trend, it also raises the possibility that a market correction is approaching.

Ankr recently announced a partnership with IT giant Microsoft, which caused the price of the ANKR token to increase by 75%. Ankr’s proficiency in offering infrastructure solutions that link developers, apps, and consumers to the newest layer of the internet, Web3, is a key component of the relationship. The two businesses want to give people creating new Web3 experiences for the next billion consumers access to high-performance blockchain connectivity.

This partnership is important for Ankr at this moment since the coin is going through a downturn and trading volume is declining. Yet, rather than being an indication of a potential price decline, this might simply be a reflection of the market’s overall tendency. Yet, the news of the cooperation has undoubtedly increased investor interest by 65%.

ANKR has just partnered with Microsoft, which is surely a significant accomplishment for the business. Ankr will likely benefit greatly from the cooperation with Microsoft because it is a well-known tech behemoth with a wide audience. The collaboration also emphasizes the expanding significance of Web3 and blockchain technologies in the tech sector.