Close

The blockchain landscape has seen significant growth with the emergence of various platforms, each aiming to provide unique solutions for decentralized applications (DApps) and smart contracts. Two prominent players in this space are Ethereum and Binance Smart Chain (BSC). In this article, we’ll explore a comprehensive comparison of the Ethereum network and the Binance smart chain, exploring their key features, differences, and implications for developers and users.

Ethereum currently operates on a Proof-of-Stake (PoS) consensus mechanism, but is transitioning to Ethereum 2.0, which fully implements PoS to increase scalability and energy efficiency.

Ethereum places a strong emphasis on security and decentralization, relying on a large, distributed network of nodes to validate transactions and execute smart contracts.

Ethereum introduced the ERC-20 and ERC-721 token standards, which facilitated the creation of fungible and non-fungible tokens (NFT), respectively.

The Binance Smart Chain, which was launched by the Binance digital currency exchange, is designed as a parallel chain to the Binance chain. BSC enables the creation of smart contracts and DApps with a focus on high performance and low transaction fees.

BSC uses a proof-of-stake (DPoS) consensus mechanism that enables faster transaction processing and increased throughput. Validators are chosen by BNB (Binance Coin) holders.

BSC is interoperable with the Binance chain, allowing users to seamlessly transfer assets between the two blockchains. This integration increases flexibility for users and developers.

One of the key advantages of BSC is its lower transaction fee compared to Ethereum. This makes BSC an attractive choice for developers and users looking for cost-effective transactions, especially in the decentralized finance (DeFi) space.

BSC is often praised for its scalability, offering faster transaction processing times and lower fees compared to Ethereum. However, Ethereum is actively working on improving scalability with its Ethereum 2.0 upgrade.

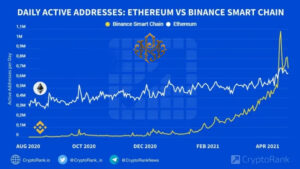

Ethereum has an established and mature development ecosystem with a large number of developers, projects and tools. Being relatively newer, BSC has been growing rapidly and gaining popularity, especially in the DeFi sector.

Ethereum prioritizes security and decentralization, which can lead to slower transaction times and higher fees during periods of network congestion. BSC, on the other hand, prioritizes speed and cost efficiency, making it suitable for specific use cases but potentially raising concerns about centralization.

Ethereum has been the platform used for a wide variety of applications, including DeFi, NFTs, and decentralized exchanges. BSC has been noted for its cost-effective transactions, making it popular in DeFi, yield farming, and token exchanges.

Both Ethereum Smart Chain and Binance contribute significantly to the blockchain ecosystem, each with their own unique strengths and focus. Ethereum has long been a leader in smart contracts and decentralized applications, with an emphasis on security and decentralization. With lower transaction fees and high throughput, the Binance smart chain has quickly carved out a niche for itself, especially in DeFi applications. The choice between Ethereum and BSC often depends on the specific needs of developers and users, balancing factors such as security, speed and transaction costs. As the blockchain space continues to evolve, these platforms will likely influence and complement each other in shaping the future of decentralized technologies.