Close

After the Shapella, deposits quickly increased, which helped the price of ETH rise, but on-chain data indicates that 1.4 million ETH will soon be withdrawn.

The long-awaited Shanghai and Capella update for Ethereum was enabled on April 12, and according to Nansen statistics, the total number of withdrawals in the first 40 hours following the Shapella upgrade was 142,425. This is consistent with earlier projections.

When Shapella was turned on on April 12, deposits into ETH staking contracts briefly surpassed withdrawals. However, after April 13, deposits have slowed down while withdrawals are still running strong.

The validators are needed to update their staking software clients with withdrawal credentials that now lead to a legitimate Ethereum address and have their withdrawal credentials changed from 0x00 to 0x01. When validators complete that step, the partial withdrawals—that is, the withdrawals of rewards that are worth more than 32 ETH—will be handled automatically.

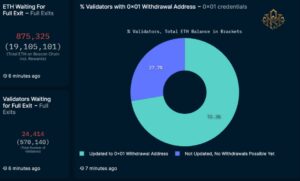

With 407,851.20 validators worth over $850 million scheduled for withdrawal, over 70.1% of validators have moved to the 0x01 code.

Also awaiting full evacuation are 875,325 ETH valued $1.85 billion. In addition to the 1.42 million ETH that has already been handled in the first 40 hours, more will be taken out of the staking contract.

Rate limits on ETH withdrawals will be set at 1,800 validators per day, or 57,600 ETH per day based on 32 ETH per validator. It translates to a possible daily selling pressure of about $120 million with 875,325 ETH waiting for full departure.

There will be a total of 136,000 and 173,000 ether withdrawn every day in the first three days, at which time partial withdrawals will also be handled.

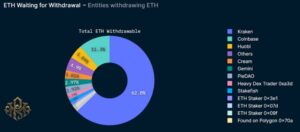

The aforementioned figures should be interpreted cautiously, though, since 62.8% of them represent forced withdrawals from the American cryptocurrency exchange Kraken in response to a $30 million settlement with the U.S. Securities and Exchange Commission to stop providing staking services.

There is a possibility that a sizable amount of Kraken withdrawals might be transferred to decentralized liquid staking platforms (LSD) like Lido, Frax, and Rocket Pool as opposed to being sold on the open market.

Interestingly, 56.07% of the withdrawals handled to date came from Lido, which raises some worry because earlier predictions stated that withdrawals from liquid staking derivative (LSD) platforms like Lido would be rather insignificant.

9.6 million staked ETH are now in profits, making them the most susceptible to a sell-off. Considering that nearly 34% of the total 17.4 million ETH deposits came from illiquid stakers, it is also uncertain if more of them will decide to withdraw their ETH.

Technically speaking, since the ETH/USD pair has broken over the $2,000 barrier level, it appears positive. Buyers will aim for the $2,300 support and resistance levels and the $2,900 breakdown levels in May 2022. Around $1,725 provides short-term downward resistance.

According to Coinglass statistics, the financing rates for ETH everlasting contracts are neutral despite the recent price increase. Typically, the everlasting market’s neutral attitude following a significant price increase indicates that traders are not yet overly enthusiastic about the current rally, which is symbolized by an increase in positive financing rates. Additionally, it gives prices greater leeway to rise.

The ETH withdrawals may put some spot selling pressure on the market, which will probably limit the upward trend.