Close

After a hotter-than-expected US Core PCE inflation report that increases the possibility that the US Federal Reserve will raise interest rates to higher levels for a longer period of time, Bitcoin was last trading lower by over 3.0% on Friday in the low $23,000 range. BTC/USD also fell back under its 21DMA for the first time in almost two weeks. According to the most recent study, MoM and YoY price pressures both surprisingly increased in January, reaching 0.6% and 4.7%, respectively.

The US money markets have responded by pricing in a 40% likelihood that the Fed would raise interest rates at least 25 basis points over the course of its next four sessions. The money market indicated probabilities for at least another four 25 bps rate rises over the course of the following four meetings were 30% prior to Friday’s data. Markets pegged the chance of a further 100 basis point rate increase at virtually zero a month ago.

As a result, the risk-averse crypto asset class is negatively impacted by the strengthening US currency, increasing US rates, and fresh selling pressure on US stocks. As they continue to evaluate the trajectory of US monetary policy, bitcoin traders will continue to keep an eye on impending significant US data releases as well as the tone of Fed members’ speech.

Yet it appears that worries about the Fed tightening will continue to be a short-term obstacle for cryptocurrencies. Nevertheless, concerns about the Fed tightening have likely been the primary cause of Bitcoin’s recent decline from prior monthly highs in the mid $23,000 range. Yet while the possibility of a retest of recent lows in the $21,400 level and a slide down towards the 50DMA in the $22,000 area looms, Bitcoin bulls might find comfort in a few recent moves in the options market that indicate the 2023 bull market is probably still intact.

The total open interest in Bitcoin options (i.e., the total value of all open options contracts) on the main cryptocurrency derivative exchanges just reached $7.83 billion, which is the biggest level in almost ten months. Options are a more complicated financial instrument that are often utilized for hedging and making bets on price direction by a more “sophisticated” investor base.

As a result, many people interpret an increase in the Open Interest in Bitcoin Options as evidence that institutions are once again investing in the market. In previous Bitcoin bull markets, institutional adoption has been a key narrative. If Open Interest continues to rise beyond its record highs of $14 billion in 2021, this story may resurface.

Deribit’s Bitcoin Volatility Index (DVOL) is still quite low compared to all-time highs. On Friday, it stood at 53, down from past weekly peaks of 60. That’s not much higher than the record lows of 43 it registered earlier this year. When the bitcoin market is negative, the DVOL frequently increases. So, the fact that it has remained stable is comforting.

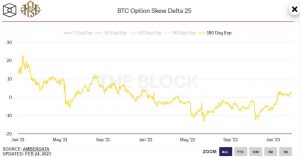

As everything was occurring, on Friday, the 25% Delta Skew of Bitcoin Options expiring in 7, 30, 60, 90, and 180 days all stayed marginally above zero, suggesting a little bullish market bias. Moreover, the 180-day 25% Delta Skew, which was recently at 2.74, is not much below its best level in more than a year and is just slightly below recent highs (the 3.28 printed in January).

the options with a delta of 25% Skew is a measure of how much trading desks overcharge or undercharge investors for upside or downside protection via the put and call options they are offering to them. A put option gives the holder the right to sell an asset at a specific price, while a call option gives the holder the right to buy an asset at a specific price.

Desks are charging more for call options than puts of equivalent value, according to a 25% delta options skew above zero. As investors are more eager to obtain insurance against (or to gamble on) a rise in prices, this might be seen as a good indication. Also, it implies that calls are in higher demand than puts.

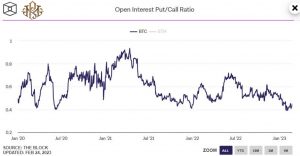

The ratio of open interest put (bets on a price decline) to call (bets on a price increase) options on Deribit, which was 0.45 on Friday, stayed very close to its record low. The end of January saw a record low of less than 0.40.

There are also an increasing number of technical and on-chain signs that, as highlighted in recent articles, all point to the end of the bear market. There are so many grounds to believe that a return to the lows of 2022 is still improbable, even though Bitcoin might not be able to continue the speed of January’s climb.