Close

Despite Greenpeace’s criticism, there are ways that Bitcoin mining may boost grid efficiency, promote the use of renewable energy sources, and establish a more sustainable financial system.

Programs for managing demand and supply for electricity have become essential. As the globe transitions to greener technology, they essentially increase grid efficiency and integrate renewable energy sources. Unexpectedly, Bitcoin mining can have a big impact on these initiatives, resulting in a more resilient and effective financial system.

However, as demonstrated by Greenpeace’s recent campaign against Bitcoin’s climate effect, not everyone is on board with this notion.

Greenpeace collaborated with artist and activist Benjamin Von Wong as part of its continuing “change the code, not the climate” campaign to spread awareness about the negative environmental effects of Bitcoin mining. It attempts to change Bitcoin’s consensus algorithm to a proof-of-stake (PoS) paradigm that is more environmentally friendly.

On March 23, Greenpeace unveiled the “Skull of Satoshi,” a work of art it had commissioned. The “Skull of Satoshi” is a 3.3-meter (11-foot) tall skull with red laser eyes and the Bitcoin logo on it.

The skull is decorated with “smoking stacks” made from discarded electronic garbage to represent the “fossil fuel and coal pollution” brought on by Bitcoin mining and the “millions of computers” required to confirm network transactions.

Bitcoin mining has the ability to benefit environmental initiatives despite the controversies surrounding its effects on the environment.

When demand for power is strong, supply is frequently overextended, which raises prices and might lead to system instability. On the other hand, extra energy, particularly from erratic renewable sources like solar and wind, might go to waste during times of low demand. The mining of bitcoins provides a remedy for this issue.

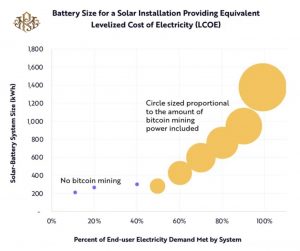

According to ARK’s analysis, 4.6 times more solar system battery capacity combined with a Bitcoin mining operation may satisfy over 99% of customer demand while still being profitable.

Bitcoin mining may act as a variable load by altering energy consumption dependent on grid circumstances thanks to its on-demand energy consumption.

Miners operate as a sort of “battery” that stores energy in the form of digital money by taking part in demand response systems, which assist absorb excess energy during times of low demand. This procedure encourages the use of natural energy sources, both existing and renewable, and balances the grid.

Using a wind-powered facility in West Texas, Bitcoin mining business Marathon Digital Holdings CEO Fred Thiel said:

“If we want more and more renewable energy to be built in this country, we need to provide a load that allows them to properly monetize that generation capacity. Bitcoin mining is the perfect load for renewable energy.”

Bitcoin mining has advantages for the environment as well as a more efficient financial system. Traditional banking and financial infrastructure based on fiat demand a significant amount of resources, such as millions of workers, tens of thousands of branches, data centers, and energy use.

The Bitcoin network, in contrast, acts as a decentralized financial backbone and requires far less staff and physical resources to run.

Because Bitcoin is decentralized, there are fewer financial system middlemen, which lowers operating costs and streamlines procedures. Because of this, Cardano co-founder Charles Hoskinson thinks that “crypto needs to de-risk itself from those unstable and volatile banks.”

The worldwide settlements made possible by the 24/7 operation of the Bitcoin network are almost instant. This is in contrast to the cumbersome old banking system, which might need days to clear and pay international transactions.

According to Cathie Wood, CEO of Ark Invest, Bitcoin, Ethereum, and other cryptocurrencies continued to work smoothly when the US financial system was in disarray as a result of bank runs endangering regional institutions. Stablecoins, which are used as entry points to DeFi, were put at risk by the banking system’s unpredictability.

Reduced energy use per transaction results from the Bitcoin network’s improved efficiency. Because of this, switching to a Bitcoin-based financial system might save a lot of energy. Mining requires less processing power than is required to keep the current financial system operational.

Wood argues that rather than obstructing the development of decentralized, transparent, and responsible financial systems that do not have central points of failure, regulators should focus on the centralized and opaque weak areas inside the old banking system.

The ability of the Bitcoin network to enhance grid efficiency and lower total energy usage will become clearer as it continues to develop and become accepted as a worldwide finance system.

Despite the criticism expressed by environmental organizations like Greenpeace, Bitcoin mining has the potential to be a game-changer for the way energy and money are produced in the future.