Cryptocurrency airdrops are a marketing strategy used by blockchain projects to distribute free tokens to the community.

Introduction to Cryptocurrency Airdrops

Cryptocurrency airdrops are a marketing strategy used by blockchain projects to distribute free tokens to the community. Airdrops aim to increase awareness, incentivize adoption, and reward loyal users. Participants typically receive airdropped tokens for holding a specific cryptocurrency, signing up for newsletters, or performing promotional tasks.

Types of Airdrops

There are several types of airdrops, including standard airdrops, bounty airdrops, and holder airdrops. Standard airdrops require participants to complete simple tasks such as signing up for a newsletter or joining a social media group. Bounty airdrops reward users for promoting the project through social media posts or referrals. Holder airdrops distribute tokens to individuals who already hold a specific cryptocurrency in their wallets.

How to Participate in Airdrops

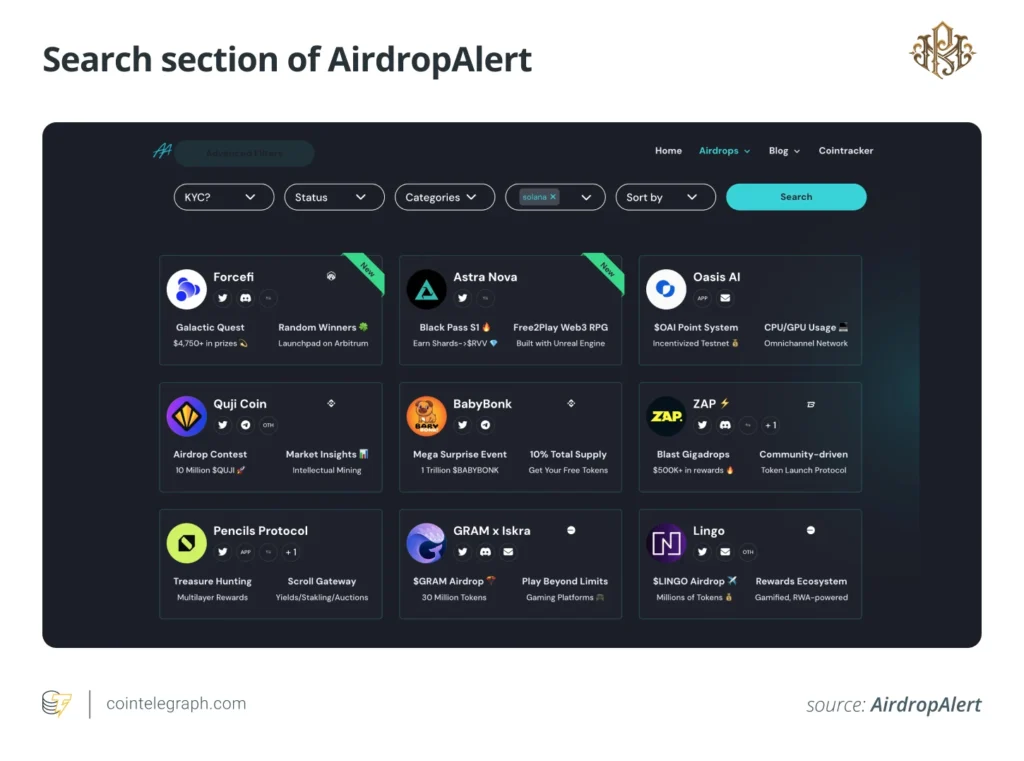

To participate in airdrops, users need to stay informed about upcoming airdrops by following blockchain projects, joining cryptocurrency communities, and subscribing to airdrop alert platforms. It is essential to use a secure wallet and ensure that it is compatible with the tokens being airdropped. Participants should follow the required steps to claim their tokens, which may involve providing their wallet address and completing specified tasks.

Benefits and Considerations

Participating in airdrops can be a lucrative way to earn free tokens and generate passive income. However, users should be cautious of potential scams and only participate in airdrops from reputable projects. It is also important to understand the tax implications of receiving airdropped tokens, as they may be considered taxable income in some jurisdictions. Conducting thorough research and due diligence can help users maximize the benefits and minimize the risks associated with airdrops.