Close

Bitcoin and the larger cryptocurrency market have taken a knock in the previous day, with bitcoin sliding below $20,000 for the first time in two months. This drop was followed by a precipitous drop in investor sentiment. Sentiment plummeted to levels not seen since January as a result of the severe dip.

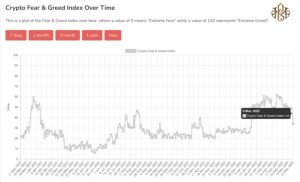

The market has been able to return to as high as $25,000 at one point in the previous two months, contributing to a turnaround in investor sentiment. As a result, the Crypto Fear & Greed Index momentarily slipped into the greed zone, but this has all come to a stop with the most recent collapse.

The index fell by ten points in a single day, one of the steepest drops seen in the recent year. With a score of 34, it indicates that investors have once again become extremely negative. As a result, panic sell-offs occur as market players attempt to avert more losses.

It’s a far way from last month’s greedy market when the index peaked at 62. The market had a similar dramatic decrease in May 2022, following the collapse of the Terra (LUNA) network.

Based on past data, it is easy to predict that the bear trend will continue. As previously stated, the last time the Crypto Fear & Greed Index experienced such a severe drop was when LUNA collapsed, causing the price of bitcoin to fall from above $30,000 to below $20,000.

If this is a continuation of the prior pattern, bitcoin may continue to fall. It is also feasible that the price may go below its present cycle low of $15,500. If this occurs, the market’s bottom may be further away than anticipated.

Surprisingly, net flows for the biggest digital assets in the industry have been practically neutral over the last day. According to a Glassnode analysis, bitcoin exchange inflows were $782.9 million, while outflows totaled $796.6 million, resulting in a negative $13.7 million net flow. Ethereum followed suit, with net flows totaling a negative $29.6 million once all was said and done.

It has always been more advantageous to enter the market when the majority is afraid to do so. This might imply that the current slump is a buying opportunity for investors wanting to get in at a reduced cost.

Bitcoin is still trading below $20,000 at the time of writing. It is currently trading at just over $19,900, down 8.21% in the previous day and down 11.16% on a weekly basis.