Close

BNB, the native token of the BNB network, has decreased by 7% since the CFTC case was made public. Long-term users are optimistic, according to on-chain statistics. Can the local currency of Binance recover in the upcoming weeks?

The primary token of the BNB chain, developed by Binance, the biggest cryptocurrency exchange in the world, is BNB. In light of governmental monitoring, the price lately experienced a correction. The U.S. Commodity Futures Trading Commission (CFTC) fined Binance on March 27 after the company had temporarily halted spot trading because of technological difficulties days earlier. According to the complaint, Binance broke safety regulations.

As the price of BNB quickly dropped, markets responded negatively. On-chain statistics, however, point to a forthcoming recovery.

Long-term BNB users don’t seem to be concerned by the current fear, uncertainty, and doubt (FUD) encircling the Binance environment, according to the blockchain data analytics platform Santiment. Mean Coin Age has significantly risen since the most recent local minimum on March 9.

The Mean Coin Age rose from an average of 44.30 days to 67.30 days between March 9 and April 4—a gain of nearly 52%.

The typical age of all the currencies in circulation is referred to as the mean coin age. The amount is determined by multiplying the total number of coins in circulation by the number of days the coins have been at their present locations.

As seen above, there has been a roughly 51% rise in the average age of coins on the BNB network. This suggests that a large number of investors are keeping their coins at the present rates.

If such investment activity continues for a long time, the underlying cryptocurrency’s price may rise as supply may start to decline relative to demand.

Similar to this, on-chain data indicates that despite the recent price decline, the native currency has not lost much momentum. This supports the optimistic view even more.

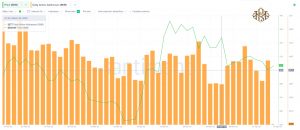

Santiment claims that there has been a favorable divergence between price and daily active addresses for the BNB network in recent weeks. Despite the price dropping 7% between March 26 and April 3, as shown in the graph below, daily network traffic has increased from 3,277 addresses to 3,947.

The BNB chain has maintained its fundamental network value, as evidenced by the 20% increase in daily active users during a 7% price decline. And if this persists, it won’t be long before the price starts to rise again.

According to the Market Value to Realized Value (MVRV 30d) statistics, BNB buyers who made their purchases within the past 30 days are resting on gains of 12%. They could wait for a further 10% price increase to $342 based on past buy/sell trends before starting to sell.

If the rise is not stopped by that sell zone, it might get close to $363. Investors could sell heavily at this time to lock in some of their 29% profits.

Still, if BNB drops below $282, the bulls could make progress. Investors could cease selling at this time to prevent their profits from dropping below 2%. However, if the decline continues, the next important support could be the 4% at $266.