Close

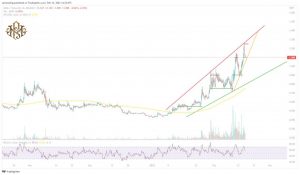

The Zero-Knowledge story is still stimulating the cryptocurrency industry. The amazing +125% gain in the $MINA coin looks likely to continue.

After a tough crypto winter, MINA is in full price recovery mode. Assisted by a surge in market interest surrounding Binance’s acceptance of ZK-Snarks, MINA has moved up to take up position 55 in the cryptocurrency rankings.

This week, MINA has seen a dramatic price increase that began in January. On January 25, a week-long barrier at $0.60 was broken by enormous +38% green candles. preparing the ground for a spectacular February rally.

Price broke dramatically last Friday after a brief period of stabilization, showing a 55% increase in just 48 hours. At $1.00, this crucially overcame significant psychological opposition.

with persistently high buying demand. A good consolidation pattern that persisted on Monday and Tuesday set up a stunning move on Wednesday.

A +41% pump occurred yesterday, pushing the price back over $1 and to a high of $1.249. Only resistance from the upper trendline at $1.25, a level not seen in 9 months since May 2022, was able to halt the enormous increase.

now sat in a nearby retracement. MINA bulls have demonstrated their ability to twice break the $1 price barrier. The key test now is whether they can consolidate here and convert $1 to support over the course of the following 48 hours.

whether the attempt is successful. The price will then likely retest $1.25, and if it does, there will be a +25% rise to historical resistance levels at $1.35.

if $1 consolidation is unsuccessful. The lower trend line, which is scheduled to converge with the 200 Day MA at $0.80, would then likely be tested for support in the event of a collapse. The bottom support line has not been touched by price movement in almost a week.

The RSI 14 confirms that there is strong purchase pressure. Reading a level 56, the RSI has rapidly decelerated from the push-up from yesterday. The RSI’s evident transition from overbought to oversold zone paints a picture of a rally with more room to go.

This optimistic outlook is also supported by the MACD, which indicates that the rise still has strength with a value of 0.005.

Open curiosity is also instructive. Despite strong indications and a bullish chart structure. According to CoinGlass, open interest is overwhelmingly short at 53.39%. This might show the mood of the market.

Overall, the downside risk is $0.80 (-26.4%), with a topside objective of $1.35 (+24.3%). MINA has a risk-to-reward ratio of 0.92.

This isn’t the best entrance, therefore it would be worthwhile to watch consolidation moves to look for a stronger entry. However, bullish structures and indicators ought to provide open positions comfort.

There are already a number of other high-potential cryptocurrencies available on the market in addition to MINA. As a result, we’ve included them in a list of the top 15 cryptocurrencies for 2023 that our staff at CryptoNews Industry Talk has evaluated.