Close

Paolo Arduino Says PayPal’s Stablecoin Launch Will Not Affect Tether In this Pooyan Music post, we will talk about PayPal’s stablecoin against Tether and the possible threats of this new stablecoin to Tether.

Paolo Arduino, CEO of Tether: The launch of PayPal’s stablecoin does not affect Tether. Because this company does not serve American users.

According to David Wells of Enkilo Markets, PYUSD will not affect the USDC circuit any time soon.

Payments giant PayPal launched a stablecoin earlier today, according to Tether CTO Paolo Arduino. Which does not affect USDT in any way.

“We don’t expect any impact on USDT,” Arduino told The Block. That’s because the PayPal stablecoin (PYUSD) has been launched in the US, Arduino said. It means where Tether does not provide service. But when asked if PYSDC would launch in international markets, Arduino said it would be positive for the crypto industry in general.

He added: “It’s interesting. Another stablecoin in the US could erode payments revenues. Which mainly helps MasterCard and Visa. It also helps to further grow the industry and enforce sensible regulations.”

Another way the PYUSD launch could help Tether is by affecting Tether competition. “This may mean further reductions in our competition,” he said. which is very focused on the United States. Tether instead focuses on emerging markets and developing countries.

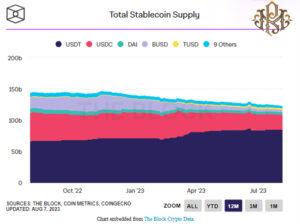

Total Supply of Stablecoins

However, according to Enclave Markets CEO David Wells, who was previously the product lead for Paxos Dollar (USDP) and Binance America (BUSD) while working for Paxos from 2017 to 2020, the immediate impact on USDC not specified.

PYUSD, which is issued by Paxos, Wells told The Block. USDC will likely compete for similar customer segments that prefer to use a US-based regulated stablecoin rather than an offshore stablecoin segment. But for PYUSD to fully compete with USDC, prior listing on cryptocurrency exchanges would be required.

“It’s unclear when/if PYUSD will be listed on major exchanges,” Wells said. So it might focus on using cross-platform payments to begin with. “Long-term PYUSD will likely compete with USDC in the cryptocurrency trading market, potentially in DeFi [decentralized finance] markets.”

Anders Holst, vice president of crypto research firm K33, echoed Wells. “One big factor in the short term is whether or not every exchange uses PayPal’s stablecoin,” Holst told The Block.

Circle did not immediately respond to The Block’s request for comment

USDT Tether is the world’s first and largest stablecoin with a total supply of more than 84 billion tokens according to The Block dashboard. USDC trails USDT with a total supply of over 24 billion tokens.