Close

The administrators of the Sports Chain bitcoin scam, which cost investors $47 million, may face criminal prosecution, according to the Central Bank of Sri Lanka.

Inflation victims who were ignorant that Sports Chain was a nonexistent cryptocurrency were promised a 500% return by the scam.

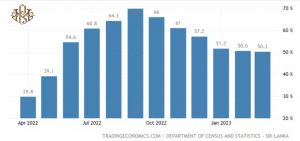

According to reports, victims who invested $47 million in the scam pawned jewels, refinanced real estate and sold cars amid skyrocketing inflation. Inflation in the island nation reached 50.6% in February 2023 as a result of the ongoing economic upheaval that began in August 2022. Since then, it has slightly eased down to 50.3%.

Nine individuals have been charged with money laundering in association with the scam so far by Sri Lanka’s Financial Crimes Investigation Division (FCID). If proven guilty, the suspects could be sentenced to five to twenty years in prison as well as a punishment equal to three times the amount of the stolen money. The defendants’ bank accounts have been blocked by the FCID, and asset seizures have begun.

Attorneys for the accused contend that the suspects cannot be held accountable for money laundering because they had no involvement in creating the app that enabled the scam.

This software was not made by our customers. Tivank Ekaratne, the accused’s attorney, claimed that they had no control over the situation.

The Sri Lankan central bank must file charges against the alleged violators of the Banking Act in order to compensate the victims.

In August 2023, the Colombo Magistrate’s Court will consider the FCID’s case.

According to Chainalysis Account Executive for North and Latin America, cryptocurrency Ponzi and pyramid scams frequently take advantage of underdeveloped legislative regimes and exchanges missing effective anti-money laundering controls in developing nations.

Additionally, the 2022 Global State of Crypto Report from Gemini showed that inflation and currency depreciation were the main forces behind the acceptance of cryptocurrencies. Investors in nations like Brazil, Argentina, and South Africa are more susceptible to fraud because of the combination of weak regulation and currency depreciation.

Crypto schemes, for instance, cost investors $11.8 million and $7.3 million in Argentina and Brazil, respectively, in 2022.

The Argentine market regulator CNV is looking into requiring evidence of viability from cryptocurrency firms in the wake of FTX’s demise. Additionally, the authority stated in February 2023 that it would form a working group to agree on regulatory guidelines.

Argentina has now become a part of the global cryptocurrency exchange Binance, which is presently under investigation by the U.S. Commodity Futures Trading Commission for weak anti-money laundering measures. Direct cryptocurrency purchases can be made by traders using Argentine pesos.

Argentina experienced near triple-digit inflation last year, which led people to engage in cryptocurrencies on platforms like FTX.