Close

The UK government is turning to cryptocurrency in an attempt to reclaim prior economic glories in the digital era.

As mentioned in Triple-A, global cryptocurrency usage is on track to exceed 750 million users by the end of 2023.

According to the survey, the top five nations in terms of estimated holders are the United States, India, Pakistan, Nigeria, and Vietnam, with 46 million, 27 million, 26 million, 22 million, and 20 million, respectively. Vietnam’s ownership proportion was 26% of the population, whereas the United States’ was 13.2%.

The United Kingdom came in last, with only 3.7 million projected holders, accounting for 5.5% of the population. Although lagging behind of other nations in terms of bitcoin acceptance, the United Kingdom’s ruling Conservative party has expressed its intention to include digital assets into its economic goals.

Despite the lingering effects of the FTX collapse, Economic Secretary to the Treasury Andrew Griffith talked in January about supporting cryptocurrency and blockchain technologies to bring about future economic gains.

Griffith stated that he hopes to transform the United Kingdom into an advanced financial hub that “certainly [has] place” for bitcoin and blockchain technology.

Griffith’s language implied that bitcoin would be the second fiddle to the pound. Yet, reading between the lines, may Griffith be purposefully downplaying the value of digital assets to the United Kingdom? Especially given the pound’s recent drop.

Historians remarked that during Anglo-Saxon periods, from 410 to 1066 AD, one pound was equal to a pound weight (454 grams) of silver, which was a substantial fortune at the time.

Yet, it wasn’t until 1815-1920, with the advent of the British East India Company, a trade association for English merchants, that the pound came to become the world’s reserve currency.

While the pound lost its reserve currency status to the dollar via the Bretton Woods agreement, the pound’s collapse was not obvious until the 1970s, when US President Nixon “suspended” the dollar’s convertibility to gold.

Faced with a financial crisis, the United Kingdom was compelled to seek a $4 billion IMF loan in 1976. A rising balance-of-payments imbalance, excessive government expenditure, and the quadrupling of oil prices all contributed to the crisis.

Adjusted for inflation, $4 billion in 1976 becomes $21.03 billion now – a 426% gain over 47 years.

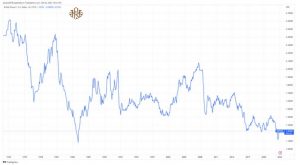

In 1972, a dollar was worth roughly £2.60, according to the graph below. By the mid-1980s, it had fallen to as low as £1.10, owing in part to a general collapse in British industry, particularly the end of the coal mining sector, and dollar strength as a result of President Regan’s major tax cuts.

The pound had a reversal of downward pressure in the late 1980s as the UK repositioned itself as a service economy, notably in financial services. Nevertheless, the macro decline re-emerged with the commencement of the last recession in 2006.

Additional downward pressure followed in 2016, when the United Kingdom voted to leave the European Union in the Brexit referendum, and more recently, when former Prime Minister Liz Truss provoked market panic with her “mini-budget” of unfunded tax cuts, causing the pound to plummet to near 1985 lows.

Far from being an isolated trend versus the dollar, the pound’s value against other major currencies, such as the yen, euro, and yuan, has also plummeted since the 1970s. In 1976, for example, one pound could purchase 700 yen. Currently, the rate is closer to 150 yen, representing an almost 80% drop in value.

The pound’s depreciation corresponds to the United Kingdom’s diminishing worldwide prominence. The phrase “Britain and the pound are shadows of their former selves” would be a courteous way of framing the issue, which Westminister is well aware of.

Recently, the United Kingdom government declared its intention to regulate cryptocurrencies, so legitimizing their existence inside its territory.

A Treasury article from February 1 emphasized initiatives to regulate financial intermediaries, including cryptocurrency exchanges, setting the framework for a favorable regulatory environment.

These initiatives will assist to build a comprehensive world-first system that strengthens laws around cryptoassets lending while improving consumer protection and business operational resilience.

Yet, to what extent are these behaviors motivated by a genuine conviction in bitcoin principles? After all, Bitcoin is the polar opposite of centralization, and it is conceptually incompatible with control systems other than personal autonomy.

In exchange for the potential economic benefits of national cryptocurrency adoption, the Treasury is likely ready to sacrifice a piece of its monetary monopoly. This call is most likely motivated by a belief that bitcoin acceptance would rise over time.

As a result, rather than championing bitcoin principles, the United Kingdom is most likely positioned itself positively in preparation for broad adoption.

Although historical system weaknesses first appeared in 1976, the pound’s collapse accelerated in the previous year as funny money initiatives were implemented in response to the health crisis.

Households in the United Kingdom are seeing a major drop in discretionary income, and ordinary people are struggling in the midst of a cost-of-living crisis, making it increasingly clear that the system is broken, even to plain people who may not be fiscally savvy.

Historically, Britons purchased property to offset inflation and currency depreciation. Nonetheless, with property prices 11 times the typical Londoner’s wage, affordability is now much above sustainable levels.

The absence of (conventional) choices for storing money in a climate of declining buying power has increased unhappiness with the financial system. People will seek fresh options, including cryptocurrency, under such circumstances. As a result, the worse things become, the faster bitcoin acceptance will spread.

It’s instructive that developing nations, where financial inclusion and economic stability are often poor, resulting in economic unhappiness, account for four of the top five projected bitcoin holdings.

The UK Treasury has accidentally confessed that people are losing trust in the pound and the traditional economic system by rubber stamping cryptocurrencies.

To be fair, declining confidence in the local currency is a problem that affects all countries, not just the United Kingdom. As the global legacy system continues to falter, bitcoin adoption patterns are expected to intensify.

Sir Jon Cunliffe, Deputy Governor of the Bank of England (BoE), told the Treasury Select Committee that the United Kingdom is 70% likely to issue a digital pound Central Bank Digital Currency (CBDC).

Opponents say that CBDCs pose privacy hazards and might be utilized for financial manipulation by governments and central banks, particularly in terms of limiting transactions and removing people’s ability to freely commerce.

Because private cryptocurrencies and a digital pound are philosophically incompatible, the commitment to both raises doubts about the UK government’s concept of an advanced financial center.

It remains to be seen how the Treasury will integrate its crypto hub idea with the digital pound if it ever becomes a reality.