Close

Data from Glassnode reveals that Bitcoin’s recent rejection around the $23,800 mark corresponded with the cost basis of a particular whale group.

According to Glassnode’s most recent weekly report, all three whale groups under consideration here went beneath for a while after the FTX disaster last year.

The “realized price,” which is determined from the realized cap, is the essential indication here. This Bitcoin capitalization model implies that the true worth of each coin in circulation is not the current BTC price (as stated by the market cap), but the price at which it was last transferred.

The realized price is calculated by dividing this cap by the total number of coins in circulation. This measure is significant since it indicates the average purchasing price in the Bitcoin market.

This means that if the regular price of Bitcoin falls below the realized price, the average holder suffers a loss. This realized price represents the market’s average cost basis, but the indicator may also be established for particular segments of the market.

The “whale” group is a crucial cohort for any cryptocurrency, and in the case of BTC, it comprises all investors who have at least 1,000 coins in their wallets. Because this group is broad and diversified, Glassnode has broken it into three subgroups to investigate the most beneficial realized prices over time.

The analytics firm split these groups by assigning distinct acquisition starting points to each. The cutoff date for the first group is July 2017, when the cryptocurrency exchange Binance was launched.

The second is December 2018 (the previous cycle’s bear market lows), and the third is the COVID bottom in March 2020. In order to determine the exact prices at which these whales purchased their coins, Glassnode solely evaluated exchange transactions.

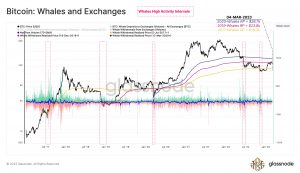

The following graph depicts how the cost bases of certain Bitcoin whale subgroups have varied over time:

As seen in the graph above, the realized price of whales from the 2017+ timeframe is currently approximately $18,000, implying that the average whale who purchased their coins between now and 2017 is currently profitable.

The 2018+ and 2020+ whales, on the other hand, appear to be losing money at the moment, with realized values of $23,800 and $28,700, respectively. Surprisingly, the current resistance to Bitcoin has been around the same level as the cost base of the previous batch of whales.

This is readily seen in the chart, where the most recent advance appears to have stalled when the cryptocurrency’s price approached this level. Historically, cost basis levels like this have frequently provided price resistance since investors who had previously lost money saw such levels as attractive selling opportunities.

Bitcoin is now selling about $22,400, down 4% in the previous week.