Close

As a result of a strong sell-off in BTC, ETH, and altcoins caused by worries over Silvergate Bank’s viability, the overall market cap of cryptocurrencies fell below $1.025 trillion.

February was a relatively quiet month for cryptocurrency markets, with a 4% increase in overall market value. The concern over regulatory pressure, though, seems to be having an effect on March’s volatility.

The technical pattern that has been driving the overall crypto market capitalization upward for the previous 48 days will surely be missed by bulls. Sadly, not all trends continue forever, and the price pullback of 6.3% on March 2 was sufficient to cause a breach below the support level of the ascending channel.

As seen above, the rising channel that began in mid-January had a floor of $1.025 trillion in market cap that was breached on March 2 when Silvergate Bank, a significant participant in crypto on- and off-ramping, saw the price of its shares fall by 57.7% at the New York Stock Exchange. A bank run might be started by Silvergate’s announcement of “further losses” and inadequate capitalization, which could cause the situation to get out of hand.

Several biggest cryptocurrency exchanges, institutional investors, and mining businesses worldwide depend on Silvergate for their financial infrastructure needs. Clients were thus encouraged to look for alternate alternatives or to liquidate their investments in order to lessen their exposure to the cryptocurrency market.

Contrary to the earlier prediction that $5 billion may be recovered in cash and liquid crypto positions, the defunct cryptocurrency exchange FTX disclosed a “massive shortfall” in its digital asset and fiat currency holdings on March 2. Nishad Singh, a former director of engineering for FTX, entered a guilty plea on February 28 for conspiracy to commit wire fraud and commodities fraud.

Less than $700 million in liquid assets remain after billions in missing client cash from the exchange and its US-based subsidiary, FTX US, were discovered. Across all wallets and accounts, FTX posted an $8.6 billion deficit, while FTX US registered a $116 million deficit.

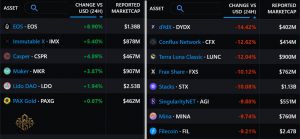

Since February 24, the entire market value has decreased 4% weekly, with the 4.5% loss from Bitcoin and the 4.8% price reduction of Ether being the main contributors. Just six of the top 80 cryptocurrencies had positive results during the previous seven days, as was to be expected.

After the EOS Network Foundation’s announcement that the Ethereum Virtual Machine’s final testnet would deploy on March 27, EOS increased by 9%.

After the project was certified as a “Unity Certified Solution,” allowing for ostensibly easy integration with the Unity SDK, Immutable X (IMX) saw a 5% increase in trading.

While investors wait for a $17 million token unlock on March 14, DYdX (DYDX) fell by 14.5%.

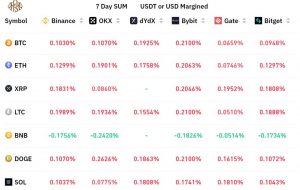

Both perpetual contracts and inverse swaps have an embedded rate that is usually charged every eight hours. Exchanges impose this fee to guard against imbalances in exchange risk.

A positive financing rate suggests that longs (buyers) are requesting more leverage. When shorts (sellers) want additional leverage, the financing rate goes negative, which is the exact opposite of the situation mentioned above.

A balanced demand between leveraged longs (purchasers) and shorts (sellers) utilizing perpetual futures contracts can be seen in the slight positive seven-day funding rate for Bitcoin and Ether. The only exception was a little larger demand for wagers against BNB’s (BNB) price, albeit it was still only 0.2% each week and not at all concerning.

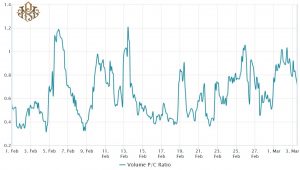

Traders can determine the mood of the market by observing if the greater activity is occurring in call (buy) or put (sell) options. Call options are often employed for optimistic tactics, whilst put options are utilized for bearish ones.

The put-to-call ratio is 0.70, which means that it is bullish since it shows that put options open interest trails behind the more bullish calls. A 1.40 indication, on the other hand, favors put options and is thus considered bearish.

With the exception of a brief period on March 2 when the price of Bitcoin fluctuated as low as $22,000, demand for bullish call options has outpaced that of neutral to bearish puts since February 25. However, the market for Bitcoin options is more heavily inhabited by neutral-to-bullish strategies that prefer call (buy) options, as seen by the current 0.71 put-to-call volume ratio.

The market shown durability from a standpoint of the futures market, so despite the negative indication from the failed ascending channel, Bitcoin traders might not anticipate further declines. The concern brought on by Silvergate Bank is reflected in the 4% weekly fall in total market value, although it is unlikely to have roots deep enough to lead to systemic risk.