Close

Support and resistance levels are basic concepts in technical analysis that play an important role in identifying potential price reversal points in financial markets. Understanding these concepts is essential for traders and investors looking to make informed decisions and improve their trading strategies. In this article, we will explore the concepts of support and resistance, examine their importance, and provide practical insights on how to use them effectively in trading.

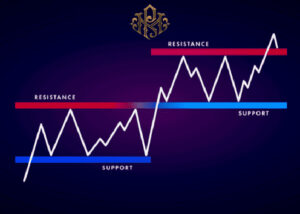

Support and resistance levels are price levels where a financial asset tends to find buying (support) or selling (resistance) pressure. These levels are formed as a result of market psychology, which indicates the areas where buyers and sellers are active in that market.

Support Level: A support level is a price level at which a financial asset is willing to buy and prevents the price from falling further. This represents a point where demand is greater than supply, leading to a potential reversal in price direction.

Resistance Level: A resistance level is a price level at which a financial asset faces selling pressure and prevents further price increases. This marks the point where supply exceeds demand, leading to a potential reversal in price direction.

Support and resistance levels perform several vital functions in technical analysis

Price Reversals: Support and resistance levels often serve as key turning points in price action, indicating potential reversal areas that traders can enter or exit.

Trend Identification: These levels help traders to identify the prevailing trend in the market. An uptrend is characterized by higher support levels and higher resistance levels, while a downtrend is characterized by lower support levels and lower resistance levels.

Risk Management: Support and resistance levels provide valuable insights for determining stop loss levels and defining the risk-reward ratio. Traders can place stop-loss orders below support levels in buy positions and above resistance levels in sell positions to effectively manage risk.

Several methods can be used to identify support and resistance levels:

Price Action: Viewing historical price movements and identifying significant price levels where price has previously reversed or stalled can help identify support and resistance levels.

Technical indicators: Indicators such as moving averages, trend lines, Fibonacci retracements and pivot points can be used to identify potential support and resistance levels.

Volume Analysis: An analysis of trading volume at different price levels can provide insight into the strength of support and resistance levels. High trading volume at a particular level may indicate increased buying or selling activity, reinforcing its importance as a support or resistance level.

Several trading strategies can be employed using support and resistance levels:

Breakout Trading: Traders can enter positions when the price breaks above the resistance level (breakout) or below the support level (breakout), anticipating a continued move in the direction of the breakout.

Trading Range: Traders can buy at support levels and sell at resistance levels in a trading range to profit from price fluctuations between set boundaries.

Retracement Trading: Traders can enter positions on pullbacks to support or resistance levels in an established trend and look to capitalize on temporary corrections before the trend resumes.

Support and resistance levels are essential tools in the arsenal of technical analysts and traders. By understanding these concepts and incorporating them into their trading strategies, traders can increase their ability to identify potential reversal points, effectively manage risk, and capitalize on trading opportunities in the financial markets. Mastering the art of support and resistance analysis requires practice, observation and a deep understanding of market dynamics, but the rewards can be significant for those who approach it with care and discipline.