Close

On Tuesday, a well-known cryptocurrency analyst by the name of “Documenting Bitcoin” published updated statistics revealing that 9.64 million BTC, or half of all Bitcoin, worth $86.4 billion, have not been moved in the previous two years.

With 19.28 million BTC in circulation as of this writing, the amount of unclaimed coins makes up almost 50% of the total supply. Unmoved BTC is calculated as a percentage of the total BTC supply in holders’ wallets during a specific time period.

According to the statistics, 50% of the Bitcoin that is now in use has been kept safe and sound in its wallet for two years. This occurs during a time when institutional investors started adopting digital assets more often. Institutions have been buying enormous amounts of Bitcoin and hoarding it without the intention of selling it for a long time. This has contributed to the cryptocurrency’s value rising.

Despite price fluctuations over the past two years, the majority of investors have chosen to retain Bitcoin, which reached its all-time high of $69,000 in November 2021. Despite the industry experiencing a severe bear market, institutions continue to believe in the long-term promise of cryptocurrencies and have been increasing their holdings.

Data made public in November of last year revealed that 62% of organizations with cryptocurrency holdings had raised them in the preceding 12 months. According to the study, only 12% of institutional investors had cut their exposure to cryptocurrencies, indicating that even if prices have fallen, most institutions continue to be positive on cryptocurrencies over the long run. Naturally, the crypto winter provided a chance for long-term consumers to purchase the drop.

The fact that half of Bitcoin has not changed in two years suggests that the virtual currency is becoming a store of value, a kind of electronic gold that individuals may use as a hedge against inflation. This is a crucial milestone for the Bitcoin ecosystem as it signifies an increase in investors’ long-term stability and trust.

There are a total of 21 million BTC in Bitcoin. Cryptocurrency continues to benefit from an ever-increasing demand that is supported by a fixed supply, continuing to be a long-term positive fundamental.

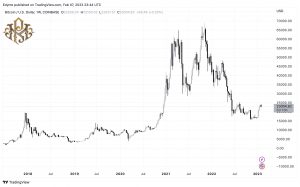

According to the price chart below, in December 2021, Bitcoin was priced at about $50,000. But at the start of 2022, everything started to go wrong. Its cost decreased below $42,000 in January of last year.

The cryptocurrency was priced at above $39,000 in May before dropping sharply to $29,000. The cryptocurrency asset’s price ranged between $19,000 and $20,000 in June. The BTC price sank below $16,000 in November, and since then, the cryptocurrency has managed to rise on the strength of stronger macroeconomic linkages.

This year, Bitcoin has seen a 30% increase in value so far. With a $24 billion trading volume, the cryptocurrency is presently trading at $23,011, up 0.43% over the past 24 hours. With a $443 billion market valuation, the digital asset is the most well-known cryptocurrency, according to Coinmarketcap.