Close

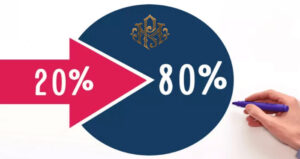

What is Pareto’s 80/20 rule and how does it apply to digital currencies? The Pareto principle emphasizes how important it is to identify key players, large cryptocurrencies or influential projects. To learn more about this law, stay with Pooyan Music site.

According to the Pareto principle, commonly referred to as the 20/80 rule, approximately 80% of the effects are caused by 20% of the causes. Vilfredo Pareto, an Italian economist, observed that at the beginning of the 20th century, 20% of the Italian population owned 80% of the country’s land.

Since then, this principle has been used in many different sectors over the years. But what does the 80/20 rule mean for blockchain technology? In the field of cryptocurrencies, the Pareto principle can be observed in several ways, which we discussed below.

A small percentage of nodes, typically around 20%, carry the bulk of the computing load for network security. They also protect the integrity and safety of the entire blockchain network. These nodes, often managed by important institutions, are disproportionately involved in maintaining the stability of the network.

A small percentage of wallet addresses hold the vast majority of coins in several cryptocurrencies. A small group of investors, called whales, can significantly influence the market. The 80/20 rule corresponds to this concentration of wealth.

The vast majority of investor interest and investment in initial coin offerings (ICOs) and token launches is devoted to a relatively small number of projects. The 80/20 success rule is the result of investors focusing on businesses with strong teams, original concepts and promising technologies.

A large number of advanced applications are created by a small group of developers and users on blockchain platforms such as Ethereum that support smart contracts. This small group of people and businesses have a significant contribution to the creation and application of smart contracts. They also affect the development of blockchain technology as a whole.

Important ethical questions are raised by the concentration of wealth in the crypto industry, reflecting deeper socio-economic problems. The power imbalance caused by the concentration of wealth by whales undermines the decentralized spirit that digital currencies seek to promote. At the same time, it perpetuates existing injustices.

Moreover, market manipulation may result from the concentration of wealth. Given their huge reserves, whales have the power to influence market prices and create artificial volatility that hurts smaller investors. Additionally, widespread concerns about insider trading, pump-and-dump schemes, and other forms of market manipulation erode trust in the entire cryptocurrency ecosystem.

The digital divide has widened with the concentration of wealth in cryptocurrencies. The democratizing potential of digital currencies is limited when wealth is concentrated in the hands of a few people, hindering financial inclusion and social progress.

Another ethical issue is the impact on the environment. Mining cryptocurrencies, especially in proof-of-work (PoW) systems, requires a lot of processing power, which consumes a lot of energy. When a small number of companies dominate the majority of mining operations, environmental costs increase and raise ethical concerns about resource sustainability and efficient resource use.

Some of these problems can be mitigated by promoting wider adoption of digital currencies, increasing transaction transparency, and other measures.

The 20/80 rule, which states that decisions are often significantly influenced by a small proportion of participants. This law can be used to examine the Pareto effect of governance structures on digital currencies. The Pareto principle affects the governance structures of digital currencies in the following ways.

A significant amount of the total supply (about twenty percent) is controlled by a very small number of major investors, early adopters or powerful institutions in many cryptocurrency networks. Due to their significant ownership, these organizations have a disproportionate influence (about 80%) on governance choices. They have the power to influence decisions on proposals, votes and protocol updates in a way that benefits them.

About twenty percent of token holders (on average) actively participate in governance mechanisms such as voting and proposal systems. But normally, these twenty percent of the participants cast about eighty percent of the total votes. As a result, this active minority has a significant impact on decisions.

When cryptocurrencies use financing methods such as treasury or development aid, only a small number of businesses or projects (around 20%) may receive the majority (around 80%) of funding. For this reason, these well-funded projects have a greater impact on the progress and development of digital currencies.

Investors can better control their risk and increase their potential for sustainable profits by following the 20/80 rule when navigating the complex crypto ecosystem.

Applying the Pareto Principle may help guide a strategic and focused approach for cryptocurrency investors. Instead of spreading their investments across a large number of digital assets, investors can focus their resources on 20% of valid and influential digital currencies.

This strategic focus enables greater understanding of key market participants and enables investors to make wise choices based on in-depth review and analysis. Investors can benefit from the stability and market dominance of these established assets by allocating more of their investment portfolio to these important digital currencies.

In addition, the 80/20 rule can be extended to investment timelines. It is possible for investors to take a long-term view and allocate eighty percent of their capital to established cryptocurrencies for long-term ownership.

This strategy is in line with the idea that the key to sustainable and long-term growth is to focus on the most valuable assets. It also allows investors to take advantage of market fluctuations for faster profits.

To reduce the adverse effects of the Pareto principle on the crypto industry, fairness, accessibility and inclusiveness should be actively promoted. One of the strategies to support decentralized access to financial services is to remove geographic and socio-economic restrictions.

In addition, projects should consider fair launches and airdrops, distributing tokens widely throughout the community and preventing early adopters from receiving an unfair advantage from token sales or ICOs.

Progressive decentralization is a new tactic to mitigate the negative effects of the Pareto principle on the crypto industry. For effective decision-making, this model requires an initial stage of concentration, followed by a gradual transition to decentralization.

Using this approach, users are empowered by the transparent implementation of processes such as decentralized governance and community voting, which ensures an even distribution of power and promotes a fairer cryptocurrency economy.