Close

The Graph [GRT] protocol is a decentralized protocol that enables users to access and index data from several blockchains. A network of nodes called as Indexers provides these functions.

Indexers must stake GRT tokens as collateral in order to join the network, and they can either stake or delegate their tokens to third parties. Yet, the network is increasingly seeing delegators rather than stakeholders.

Staking introduces GRT tokens into the protocol as a kind of security for joining the network as an Indexer. Indexers stake their tokens, effectively locking them up as collateral, to guarantee that they are incentivized to operate in the best interests of the network.

The delegation, on the other hand, allows someone else the authority to stake your GRT tokens on your behalf. It allows anyone to join in the network and receive rewards even if they do not wish to run their own Indexer.

When they delegate tokens to an Indexer, they lend them to the Indexer as collateral.

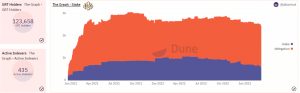

Data from Dune Analytics show that the network has always had more delegators than stakeholders. The predominance of delegations might be attributed to how simple it is to transfer GRT tokens to others rather than dealing with the complexities of staking.

There were around 1 billion delegates and 500 million stakeholder participants at the time of writing.

According to staking rewards statistics, the total amount of GRT staked as of this writing was 26.41%. Furthermore, the staked GRT had a market worth of almost $311 million at the time of writing.

According to CoinMarketCap, the total market cap was more than 990 million.

Although The Graph network offers excellent stakes, its price may have been lower recently. On a daily basis, GRT was down more than 3%, trading at roughly $0.11 at the time of writing.

GRT’s price trend was so bleak that it was approaching oversold territory. The relative Strength Index (RSI) line was significantly lower than the neutral line and far below 40.