Close

The number of Bitcoin wallet addresses holding a non-zero balance of the first, most widely used, and largest cryptocurrency by market capitalization reached a new record high this week, indicating that the global adoption of the Bitcoin network is still moving forward despite the challenging bear market of 2022 and the unfavorable 2023 outlook for the global economy.

The number of Bitcoin addresses with a non-zero balance surpassed 43.8 million on Wednesday, January 8th, according to statistics provided by the crypto analytics company Glassnode. This increased the number of addresses over the previous record high of 43.76 million printed back in mid-November 2022.

An increase in bitcoin self-custody was brought on by the collapse of FTX, which was formerly among the biggest cryptocurrency exchanges in the world, and caused clients to lose access to billions of dollars in cash. When investors hurried to remove their Bitcoin from exchanges, address numbers shot up.

Nevertheless, as a result of wallets giving up and Bitcoin’s price plummeting to new 2022 lows amid concerns over the insolvency of FTX, there was a quick decline in non-zero address counts.

In order to draw enough new investors back into the Bitcoin market and raise the number of non-zero wallet addresses back to a record high, the price of Bitcoin has had to increase by about 40% since the beginning of the year amid optimism for a better macroeconomic backdrop in 2023 and increased on-chain and technical signs that the bear market is over.

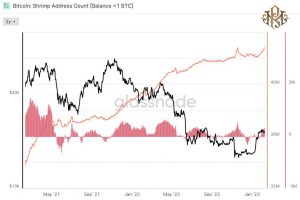

The most recent increase in non-zero address numbers has, predictably, been driven by a rise in wallets holding a tiny amount of Bitcoin, according to Glassnode statistics on Bitcoin wallet address cohorts. A new record high of over 42.827 million so-called Shrimp wallets—wallets that may handle less than one bitcoin—has just been reached.

The number of addresses holding 1-10, 10-1K, and more than 1K BTC, respectively, has all stalled for Crab, Fish, Shark, and Whale addresses. After the FTX crash, the number of Crab, Fish, and Shark wallets initially increased as larger investors took advantage of the chance to buy the decline in the price of bitcoin.

Thus, it can be deduced that a shift in Bitcoin ownership away from larger investors and toward new, smaller investors is occurring along with the recent increase in non-zero wallet address numbers. Given their strong conviction in the future of cryptocurrencies, larger investors are considerably more likely to belong to the HODLer camp, It includes those who buy Bitcoin and hold on to it for a long period.

Additionally, there is growing indication that the Bitcoin market may be starting to transition from HODLers to new investors, a pattern that frequently occurs at the start of a new Bitcoin bull market.

Realized HODL Ratio (RHODL), a ratio of the two Bitcoin age bands, according to Glassnode, appears to be bottoming out. The RHODL is a calculation that compares the number of coins that haven’t moved for 1-2 years with the number of coins bought during the last week to determine the spread of Bitcoin wealth distribution between experienced and novice investors.

The RHODL saw its lowest price during the 2019 bear market in late December, but it has since experienced a respectable return. The RHODL captures an increase in demand for BTC from new investors, with more involvement in the Bitcoin market traditionally correlated with long-term price growth. As can be seen in the accompanying chart, RHODL rebounds often go hand in hand with a rising Bitcoin price.

Does this indicate that the price of bitcoin will increase in the future given the rise in non-zero wallet addresses? Well, maybe not always. Throughout most of 2022, non-zero address numbers increased (slowly), but this wasn’t enough to stop the bear market. As seen by the rise in the dominance of older coins in the RHODL ratio, demand from new dip-buying investors wasn’t adequate to stop price downward as a result of the capitulation of weak-handed short-term investors.

Rising non-zero address numbers most likely need to be supported with data showing that wealth in BTC is also shifting in favor of newer investors, which at the moment seems to be the case.