Close

Despite the fact that a sizable portion of the cryptocurrency community believes memes to be of little to no use, Dogecoin [DOGE] and Shiba Inu [SHIB] have shown to be useful in other contexts. These canine-themed cryptocurrencies have excelled in one area, which is “liquidity.”

Right, surprising? That’s because there is a widespread misunderstanding about how to evaluate an asset’s liquidity level. Market capitalization is often regarded by investors as the most accurate indicator of an asset’s liquidity. But that doesn’t really paint a picture for us.

Conor Ryder clarified the situation through his Medium page on December 8, 2022. The analyst at Kaiko Research claims that the adopted market size is not as important to liquidity as the volume, market depth, and spread

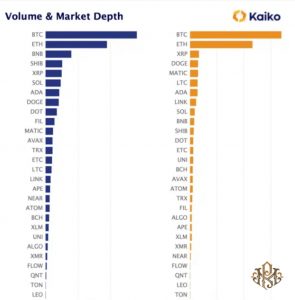

Overall, DOGE was ranked higher in terms of liquidity than BTC and ETH according to Ryder’s Kaiko statistics. This conclusion demonstrates how estimating the working capital of an asset is not just based on its market value.

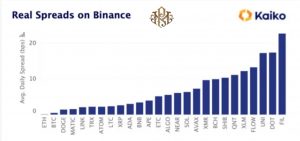

How, therefore, did DOGE surpass the crypto kings? Despite not having a significant volume impact, DOGE ranked third according to the depth and spread of the market.

The spread of an asset is calculated by comparing the best bid and best ask during an interval in an order book.

Therefore, inadequate liquidity is indicated by an open broad spread, and vice versa. It’s interesting to note that DOGE’s expansion only trailed behind that of Bitcoin [BTC] and Ethereum [ETH].

The constricted propagation of the meme allowed it to outperform Binance Coin [BNB], the fourth-ranked cryptocurrency in terms of market value. Well, Cardano [ADA] and Ripple [XRP] both placed lower than DOGE.

The market depth, one of the greatest indications of liquidity, takes into account the full number of open orders on the bid or ask side, and according to Kaiko statistics, DOGE placed fourth, with only BTC, ETH, and XRP ahead.

As a result, DOGE’s position suggested how simple it was to determine the coin’s inherent worth. SHIB, on the other hand, lagged behind in terms of market depth.

It was weak there because of its vast distribution. Excellent liquidity does not always translate to a price gain, regardless of the circumstance. Thus, the issue is: In what respects has Shiba Inu fared better than Dogecoin and other cryptocurrencies?

SHIB, which outperformed its nearest rival DOGE in the race, was the most popular token in terms of volume. Of fact, it’s a common misconception that volume and order books are related.

However, several instances have demonstrated that there are instances of manipulation and wash trading. The market value and volume alone are not the best indicators of liquidity, thus here is why.

However, according to Santiment statistics, DOGE outperformed SHIB at press time in terms of on-chain volume. SHIB had a volume of 434.36 million while DOGE had a volume of 594.71 million. However, a review of the previous six months showed that SHIB outperformed its rival in that area.