Close

According to data, the amount of Bitcoin spot trades has been constant over the last week, but Binance has become even more dominant.

The most recent weekly analysis from Arcane Research indicates that the trade volume for bitcoin has remained constant at about $10 billion during the past week. The total volume of Bitcoin traded on the Bitwise 10 exchanges in a particular day is represented by an indicator called “daily trading volume.”

Due to their reputation for providing the most accurate market data, the metric solely uses volumes from the Bitwise 10 exchanges. Even if there are other platforms in the industry, their trading volume trend can still give a good indication of the trend in the larger market.

When the indicator’s value is high, there are a lot of coins being traded on the spot market right now. A pattern like that may indicate that traders are present in the market.

On the other side, low levels imply that there is currently little activity on the Bitcoin spot market. This type of pattern may indicate that investors aren’t currently showing much interest in the asset.

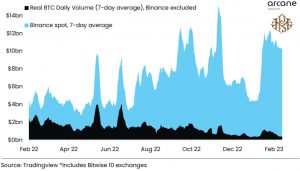

Here is a graph showing the trend in the 7-day average daily trading volume of bitcoin over the previous 12 months:

The 7-day average daily trade volume for Bitcoin has been at high levels of around $10 billion during the past week, as shown in the graph above. On the cryptocurrency exchange Binance alone, the great bulk of this volume is concentrated, as is clear.

The indicator has only had a value of $390 million in the spot market outside of Binance over the past seven days, which is the lowest it has been since January 7, 2023.

This indicates that Binance provided 96% of the current trading volume across the Bitwise 10 exchanges. Volumes on exchanges like Coinbase, Kraken, and Bitstamp have decreased recently, which is the cause of this rise.

The trading volume typically declines while the price of bitcoin is trading sideways because investors tend to find consolidating markets uninteresting and refrain from making numerous trades. It’s hardly surprising that volumes aren’t particularly high in most exchanges given that BTC is now exhibiting stale movement.

The report explains that rotation from BUSD to USDT via Binance’s BTC pair may explain some of the elevated Binance volume over the past month, as both the BTCBUSD and BUSDUSDT pair have experienced elevated volumes against the backdrop of the Paxos news. This is why Binance’s volumes are still so strong and the platform is actually becoming more dominant.

At the time of writing, the price of Bitcoin is at $22,100, a 4% weekly decline.