Close

Despite the recent price volatility, Bitcoin (BTC) investors are displaying a high level of optimism, and the Fear & Greed Index tracked by Coinstats Explorer indicates a strong and bullish market sentiment. The indicator is currently close to the year’s high at a level of 64, indicating that investors are more hungry than afraid.

The Fear & Greed Index calculates a score between 0 and 100 based on a number of variables, including as social media postings and Google Trends, to determine the state of the bitcoin market. A score of more than 55 denotes a predominance of greed, whereas a score of less than 45 denotes fear. In spite of recent price swings between USD 31,000 and USD 26,600, the indicator demonstrates that BTC investors are still upbeat about the cryptocurrency’s future.

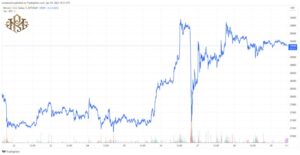

Since the beginning of 2023, the price of Bitcoin has remained bullish, peaking at 68 this month. Since Bitcoin hit its record high of $69,000 18 months ago, this level has not been seen. The price of the cryptocurrency reached a height this month of $31,000, which is the highest level in over a year, with a level of 68 greed. Bitcoin later dropped to $26,600, but the market mood is still positive.

Renewing forecasts about the future of the top currency have been made as a result of the current price increase over the last week from analysts and stakeholders. While some predict a significant correction, others see the market trend favorably.

Michael van de Poppe, a well-known market expert, is one of them and thinks that Bitcoin would benefit from a pullback. If Bitcoin stays over $25,300, he believes it will continue to rise toward the $40,000 to $50,000 range. Using a chart, Van de Poppe expanded on his ideas by demonstrating how this price level has historically been important, acting as a support and resistance area for the lowest and maximum Bitcoin prices in 2021 and 2022.

With Bitcoin’s growth of over 60% so far this year, according to Van de Poppe, it may continue to increase and reach a price of over $40,000 in the second half of 2023. Additionally, he sees a reversal to $30,000, which would turn into its support.

But he pointed out that for this scenario to be true, the US Federal Reserve must remain committed to its current monetary policy. The Fed’s determination to raise interest rates is not currently showing any signs of shifting, which might have an effect on the price of cryptocurrencies.

This prognosis is likewise held by well-known market expert Santino Cripto. By August, he projects that Bitcoin will be worth $40,000. The fact that BTC’s increased minimum prices suggest an upward trend is one of the justifications given for this prognosis. He asserts that the market correction this week is comparable to prior weeks and demonstrates a normal and logical phenomena during a bullish season.

At the time of writing, Bitcoin has gained 1% over the previous day and is currently selling for $29,319 with a market share of 47%.