Close

In the long run, the price of Bitcoin (BTC) exhibits a number of optimistic indicators. The short-term trend’s direction is still not evident, though.

According to Federal Reserve data, bank deposits in the United States significantly declined between March 8 and March 15 as a result of concerns about a banking collapse. At the same time, there were more investors holding Bitcoin (BTC). The head of research and strategy at Matrixport stated that Americans are buying Bitcoin with both hands. On the other hand, net exchange inflows for bitcoin reached a 10-month high. Similar times of large inflows have in the past come right before abrupt drops.

Since March 10, the price of Bitcoin has dramatically surged. It rose by approximately 50% during the course of 14 days, setting a new annual high of $29,380. The price, however, produced a bearish candlestick and has subsequently marginally declined. (red icon).

The daily RSI reading is positive even if the rise has stalled. The indicator has risen over 50 after breaking above its bearish divergence trend line (black).

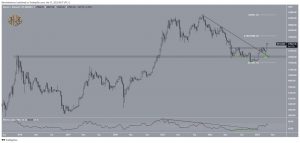

The price of one bitcoin fluctuates between $24,400 and $31,800. The likelihood of an eventual advance to $31,800 is increased because the RSI reading is optimistic.

The BTC price bounced at an ascending support line, which defined its slope in the quick phase of the rally, according to the technical analysis from the six-hour time frame. Then, a short-term declining resistance line was broken by the price.

If the price rises further, it can reach the range high of $31,800.

A collapse, however, would probably cause a decline to $24,450, the 0.5 Fib retracement support level. This level is crucial since it also falls inside the previously described horizontal support region and has the potential to cause a bounce.

The weekly Bitcoin price chart for BTC shows a positive outlook even though the daily and six-hour time frames have some contradicting signals. There are several explanations for this.

First, a long-term declining resistance line that had been in place since the record high was broken by the price. Once it had been verified as a support throughout the week of March 6–13, it then quickened the rate of growth. (green icon). The price then rose to its highest level since June 2022 after breaking free of the $24,700 horizontal resistance region. The $24,700 region is now anticipated to offer assistance. The region almost exactly matches what is described in the daily time period.

In addition to the price movement, the RSI reading is clearly optimistic. After producing bullish divergence, the indicator broke out from a declining resistance line (black). (green). Then, it surpassed 50. These are all seen as bullish indicators.

The 0.382 Fib retracement resistance level at $35,680 will be the next barrier if the rise persists. On the other side, the bullish prediction would be invalidated if the price closes below $24,700. In that situation, a decrease to $18,600 might occur.

In conclusion, a climb to the long-term $35,680 resistance region is the most plausible Bitcoin price prediction. Only if the weekly close dropped below $24,700 would this become invalid. In that situation, a drop of $18,600 may occur.