Close

The CFTC’s recent action against Binance seems to have had little impact on the BTC options and futures markets, but is that a good or negative sign?

After Binance and its CEO Changpeng “CZ” Zhao were sued by the US Commodity Futures Trading Commission (CFTC) on March 27, the price of Bitcoin dropped 3.6% to $26,900. The CFTC, the US Securities and Exchange Commission (SEC), the Internal Revenue Service, and federal prosecutors have all looked at Binance thus far.

The Silicon Valley bank’s successful asset sale to First Citizens BancShares at a $16.5 billion discount, which secured an unprecedented credit line from the Federal Deposit Insurance Corporation (FDIC) to cover any future losses, may have prevented a worse drop in the price of bitcoin.

On March 27, when Russian President Vladimir Putin heightened geopolitical tensions in Europe, oil prices also rose by 5%. In order to terrify the adversarial nations over its backing for Ukraine, Russia reportedly intends to place tactical nuclear weapons in Belarus’ neighbor.

After a U.S. Federal Judge decided to temporarily freeze the proposed sale of Voyager Digital to Binance.US on March 27, there was further unrest in the cryptocurrency sector. The motion for an emergency stay was approved by Judge Jennifer Rearden of the U.S. District Court in New York.

Let’s look at stats for Bitcoin futures to see where professional traders are right now in the market.

Whales and arbitrage desks prefer to trade quarterly Bitcoin futures, which frequently trade at a little premium to spot markets, indicating that sellers are asking for a higher price in order to delay settlement for a longer period of time.

Futures contracts should thus trade at a 5% to 10% annualized premium on healthy markets, a condition known as contango that is not specific to crypto markets.

Despite the fact that the exchange controls 33% of the $11.2 billion in open interest, the Binance announcement had little impact on the premium for Bitcoin futures. 3.5%, less than the neutral 5% threshold, is the 2-month contract premium. The indication would have swiftly changed to 0 or even negative if there had been any panic selling using leveraged futures contracts.

Lack of demand for leveraged long positions does not always indicate a price decrease. As a result, investors should research the options markets for Bitcoin to understand how market makers and whales assess the possibility of future price changes.

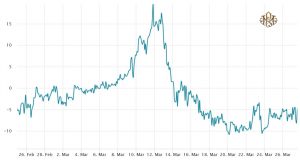

Market makers and arbitrage desks are clearly overcharging for upside or downside protection based on the 25% delta skew. Options traders increase their likelihood of a price drop during bad markets, pushing the skew indicator beyond 8%. The demand for bearish put options decreases in positive markets, where the skew indicator is often below -8%.

The protective put options are now trading at a tiny discount, according to the 25% skew ratio, which confirms the lack of importance of the Binance news. More crucially, the 25% skew was unaffected by the CFTC action, showing that whales and the markets are not pricing in any appreciable changes to the market structure.

Given that experts and commentators believe it is unlikely that Binance and CZ would get much more than a million-dollar fine and a few term of conduct adjustments, the fact that derivatives indicators were hardly affected may be considered a “remote misses” effect.

The first instance of this kind of psychological distortion was noted in London during World War II, when survivors who did not face impending losses grew even more self-assured and were less prone to experience pain.

Prior to those whales and arbitrage desks seeing more than a 3.5% price correction, it seems doubtful that the market would begin to price in increasing probabilities of severe volatility.