Close

On April 19, Litecoin momentarily exceeded the $100 mark until a sell-off at the barrier sent the price down by 10%. However, on-chain data shows that hundreds of investors are placing purchase orders in queues on multiple cryptocurrency exchanges. Will the bulls and tactical whales purchase the drop and drive the subsequent LTC bounce above $110?

Decentralization and inexpensive payment methods are prioritized by the open-source blockchain system known as Litecoin. After a mixed performance in March, the LTC native coin got off to a good start in April.

LTC has fallen 10% in the previous few days due to strong resistance near $100 and a sector-wide slump in the altcoin markets. However, solid on-chain fundamentals and significant demand from strategic investors suggest that a recovery is just around the corner.

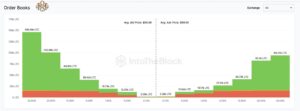

According to information gathered from the order books of top cryptocurrency exchanges, Litecoin is in great demand. Litecoin (LTC) has an excess of purchase orders at the moment, with buyers requesting 385,000 coins, while there are only 276,000 sell orders available.

The Exchange Market Depth chart in the above graphic displays the total price dispersion of market orders put in by cryptocurrency investors on multiple exchanges.

An optimistic indication signaling that buyers would be prepared to pay more for Litecoin is the discrepancy between market supply and demand. Thus, an upward trend in LTC prices is possible during the next several days.

The wallet Crypto Whales, who have balances between 100,000 and 1,000,000 LTC, have resumed purchasing, according to real-time statistics. It’s interesting to see that these whales have been selling since January 2023, when Litecoin first exceeded the $90 mark.

The graph below demonstrates how they just added 43,000 coins, totaling almost $4 million, over the course of seven days, from April 15 to April 21.

This mostly indicates that institutional and high-net-worth investors are becoming more confident and setting themselves up for future price increases. It’s vital to remember that the prior buy/sell behavior of this particular whale cohort has been strongly connected with the price of LTC.

If this pattern continues, Litecoin’s price will probably increase over the next several days.

The most recent surge for Litecoin was rejected at roughly $101, but the distribution of holders’ break-even prices indicates that the next one might go as high as $112.

LTC must first overcome the initial barrier at approximately $94. However, the 450,000 addresses that collectively own 3.45 million coins could consider selling once they reach break-even.

LTC may rise to $112 if the positive trend can overcome that hurdle. There is a larger sell-wall with 990,000 addresses holding 6 million coins in that area.

But if LTC drops below $86 then the bears could still be in charge. However, a strong reaction from 614,000 owners holding 8.27 million coins is anticipated to stop that. The price of Litecoin may retest $70 if the $86 support level fails to hold.