Close

Eight significant data points were examined, and it was found that London has the greatest level of crypto preparedness to attract firms and start-ups.

A supporting infrastructure that can give the general public access to and exposure to the ecosystem is necessary for the mainstream acceptance of cryptocurrencies, in addition to crypto-friendly policies. London tops the list of the world’s most crypto-ready cities for enterprises and start-ups when eight important variables related to taxation, ATMs, jobs, and events in the space are taken into account.

According to Recap’s analysis, UK Prime Minister Rishi Sunak’s goal to “guarantee the UK financial services industry is constantly at the forefront of technology and innovation” is on the correct track. Eight significant data points were examined, and it was found that London has the greatest level of crypto-readiness to attract firms and start-ups.

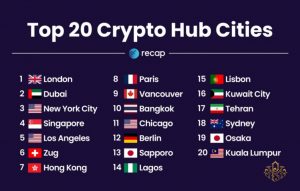

Leading metropolises like Dubai and New York made it to the list’s top three, as can be seen above. However, Hong Kong, which was ranked as the nation best prepared for cryptocurrency in 2022, dropped to sixth in the study.

The top 50 big cities with infrastructure poised for widespread cryptocurrency adoption are included in the list above.

The overall number of crypto-specific events, occupations linked to crypto, organizations focused on crypto, and the number of crypto ATMs are some of the important variables taken into account in the study.

Out of the group, London has the highest concentration of residents employed in crypto-related fields, a sign that the general population is more interested in the crypto ecosystem. However, other cities from different regions dwarf London in other criteria, supporting the argument for the widespread use of cryptocurrency.

The Bank of England (BoE) and the United Kingdom Treasury emphasized the necessity of developing a central bank digital currency (CBDC) by 2030 as part of their ongoing effort to remain at the forefront.

The “digital pound” plan, according to insiders, is expected to be unveiled by the middle of February, according to a previous article by Cointelegraph. According to reports, cash and coin payments decreased by 35% in the UK in 2020, signaling the beginning of a digital age.