Close

Retail cryptocurrency investors are being urged by the consumer advocacy organization Digital Currency Trader’s Alliance (DCTA) to contact their congressional representatives to oppose the Securities and Exchange Commission’s assault on cryptocurrency.

The “Stop the SEC” effort seeks to prevent SEC overreach from affecting retail crypto consumers by requesting that Lawmakers clarify regulations.

Kevin Trommer, the organization’s deputy director, told Fox Business that the goal of the campaign was to connect regular people with their congressional representatives so they could explain firsthand how the SEC’s enforcement-based approach to regulating cryptocurrencies is harming their investments.

Retail investors may utilize the nonprofit’s draft of a Crypto Consumer Legislative Guide to urge politicians in their home districts to support pro-crypto legislation.

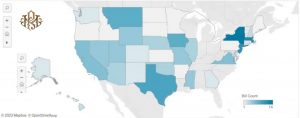

Recently, Coinbase unveiled Crypto435 as a lobbying effort to support pro-crypto policies in the 435 U.S. House Districts. Moreover, the exchange increased its advocacy last year by adding crypto ratings for politicians on its mobile application.

Coinbase and the DCTA issued the call to action after senators from many U.S. states drafted a patchwork of measures for various sectors of the cryptocurrency business in response to the effects of the failure of several crypto startups on retail investors.

The SEC has intervened with various enforcement proceedings intended to establish legal precedents for comparable future actions while these measures await the occasionally drawn-out legislative process on Capitol Hill.

According to SEC Chair Gary Gensler, the 1933 statutes are adequate to oversee cryptocurrency. Nevertheless, proponents of cryptocurrency contend that the lack of clear advice on how to apply the legislation to the sector gives the SEC latitude in how it interprets the statute.

Hester Peirce, a commissioner with the SEC, has referred to the organization’s activities against cryptocurrency platform Kraken as “paternalistic and sloppy regulation.” Prior to taking enforcement action, she pushed for communication between the business and the SEC to better understand Kraken’s offering.

In December of last year, Rep. Ritchie Torres of New York, who is rated as Positive on Coinbase’s app, sent a letter to the U.S. Government Accountability Office asking them to investigate the SEC’s involvement in the demise of FTX.

He demanded that Gensler be held to a higher standard of accountability since, while professing to be the industry’s watchdog, he failed to enact significant laws that may have revealed the purported fraud at the Bahamas exchange.

Tom Emmer, a Minnesota representative, claims that after FTX, the crypto sector needs more decentralization and transparency. He contends that the solution is not restrictive regulation that fails to acknowledge Sam Bankman-Fried as an established fraudster who prospered because US legislation forced FTX overseas.

Instead of enacting new crypto rules, he claimed, the government should deal with Bankman-Fried and stop frauds.

Yet, advocating for state legislation that support cryptocurrencies may not have the desired impact on the community.

Recently, Custodia Bank’s bid to join the U.S. Federal Reserve was denied, thanks in part to Caitlin Long, a Wyoming legislator who helped pioneer crypto legislation. Considering Custodia a Special Purpose Depository Institution unable to adhere to federal banking regulations, the central bank questioned Custodia’s state validity.

Since the demise of FTX, crypto lobbying has also received a bad rap. Sam Bankman-Fried, the company’s co-founder, is accused of breaking campaign funding regulations while working to legalize the sector on the national level.