Close

Despite regulatory hostility, the largest stablecoin once again increased its market cap. Thus, the market value of Tether (USDT) set a new record. In this post from “Pooyan Music” you will read a report about Tether’s new record breaking.

US Dollar Tether (USDT) by Tether Limited, the largest crypto stablecoin, has seen its capital increase to an unprecedented high. Its main competitor, Circle-made USDC, continued to fall to multi-year lows.

The market cap of Tether (USDT) reaches over 86 million dollars. With this amount, it has increased by 23% in one year.

On November 17, 1402, Tether Limited increased the value of its flagship stablecoin USDT by more than 300 million dollars equivalent. It hit a new record high of more than $86.12, according to CoinMarketCap data.

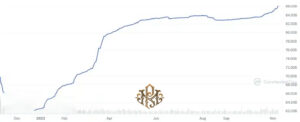

Since the previous decline in late Q4 2022, USDT market cap has been growing. In the last 12 months, this measure has increased by almost 23%.

In June 2023, Tether’s market cap returned to levels not seen since the 2022 crypto market crash. From mid-October 2023, it started to accelerate.

USDT’s dominance in the stablecoin sector has never been so clear. Because it is 153% ahead of USDC, the second largest stablecoin.

USDC’s total capital is 24 billion dollars. Compared to the record high, in the second quarter of 2022, it has decreased by nearly 56.3%.

The third largest asset, DAI, is the most capitalized (decentralized) algorithmic stablecoin with a supply of $5.34 billion.

As a centralized stablecoin, USDT is backed by a diverse set of assets. According to the Q3 2023 confirmation document, US Treasury bills account for the largest share of its portfolio.

Currently, Tether has 72.6 billion dollars in notes. As such, its exposure to US debt appears more significant than most countries, including the Netherlands ($72.3 billion) and the United Arab Emirates ($64.9 billion).

As previously reported, Tether (USDT) is focused on Bitcoin (BTC) mining software in 2023. And in October, CEO Paolo Arduino Moria showed off a Bitcoin (BTC) mining orchestration tool.