Close

This month, Bitcoin (BTC) has increased by around 28%, reaching its highest level since early November. The widely accepted theory on Crypto Twitter is that Coinbase (COIN) traders have pushed the cryptocurrency higher. The Nasdaq-listed exchange isn’t the only place where the cryptocurrency has seen positive pressure, either.

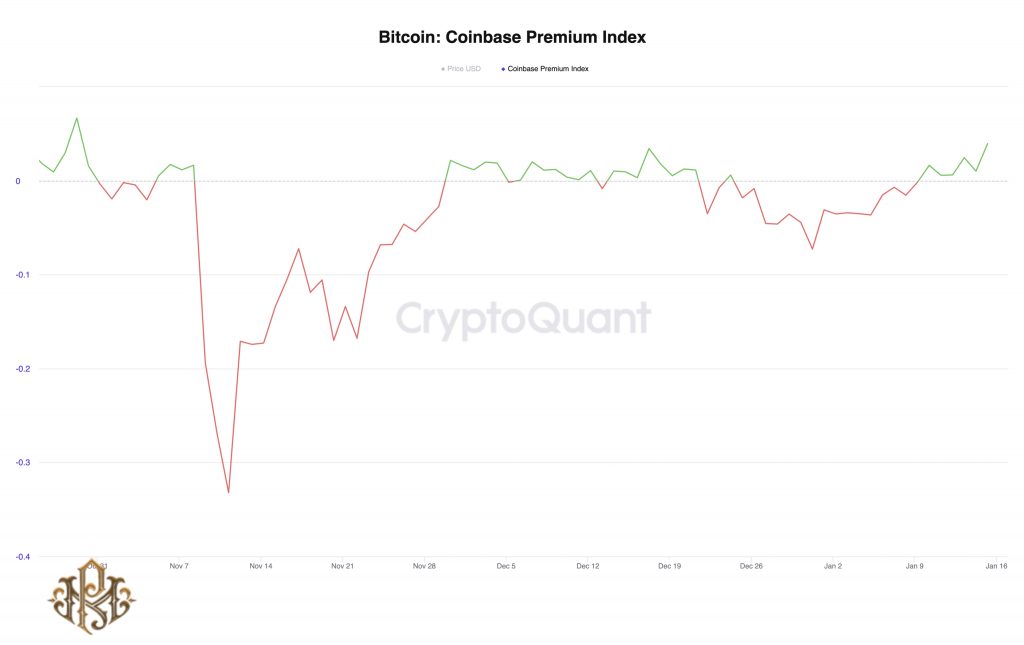

According to data from blockchain analytics company CryptoQuant, the Coinbase premium index, which gauges the difference between Binance’s and Coinbase’s BTC/USDT pair involving the tether stablecoin, turned positive last week and increased to 0.039 over the weekend, the highest level since late October.

In other words, the signal shows that Coinbase has been under significantly heavier purchasing pressure.

André Dragosch, the head of Deutsche Digital Assets, wrote in a note to clients that the price differential between Bitcoins traded on Coinbase and those traded on Binance (the Coinbase-Binance premium) “continued to be positive throughout the week, which is indicative of increased buying interest from institutional investors relative to retail investors.”

Institutions favor the regulated and publicly listed Coinbase over offshore companies like Binance, which are seen as a proxy for civilian investor engagement. Binance is currently taking action to position itself as a platform with an institutional emphasis.

The surge may have started with Binance-based firms buying for bitcoin with BUSD, a fiat-backed stablecoin produced by Binance and Paxos, in the perpetual futures market, according to another indicator called the cumulative volume delta (CVD), which tracks net capital inflows into the market. Additionally, subsequent purchasers from Coinbase and other exchanges entered the game.

A rising CVD indicates more active buyers, but a downward-sloping line indicates more active selling.

The Bitcoin/BUSD pair offered on Binance (yellow line) is compared to the CVD BTC/USD and BTC/USDT pairings listed on other exchanges and Binance in the graphic below, which was taken from Coinalyze.net and tweeted by analyst exitpump (@exitpumpBTC) using a pseudonym.

Since January 11, the yellow line has been on an upward trend, while the green line started to rise three days later. In other words, Binance’s BTC/BUSD market saw strong bidding at first, which helped to drive bitcoin’s initial surge from $17,000; afterwards, buyers from other exchanges, such as Coinbase, entered the market.

“From my observations, it was mostly one entity [from Binance] bidding and absorbing sell pressure and trying to make a breakout market buying and constantly eating the sell walls with no signs of exhaustion, which lead to short squeezes pumping the price,” exitpump posted on twitter.

Other indicators, such as the average trade size, point to a lack of defined leadership and a general increase in whale activity.

According to Clara Medalie, research director at Paris-based crypto data provider Kaiko,

“regarding the average trade size, there has been a noticeable increase on Bitstamp, Kraken, Bitfinex and LMAX Digital and a slight increase on most other exchanges, including Binance, which suggest more whale-driven price action.”

Since January 8, the typical deal size on Binance has climbed from $700 to $1,100.

At the time of publication, Bitcoin was trading for over $21,150, up about 22% from the previous week. The rise was fueled by the idea that potentially severe macroeconomic dangers were receding.

“It goes beyond just acknowledging that we have passed the point of peak inflation and that rates most likely won’t climb all that much further. Additionally, the majority of sellers have been driven off the market, according to Noelle Acheson, author of the well-known book “Crypto Is Macro Now.” “explained the price increase in the issue of the newsletter published over the weekend.