Close

New tools and approaches to comprehending and analyzing the market are continually being developed along with the crypto asset markets. The Bitcoin Stock-to-Flow (S2F) Model is one such instrument that seeks to forecast the price of Bitcoin based on its scarcity.

The Bitcoin Stock-to-Flow model, its advantages and disadvantages, and its applicability to bitcoin trading are all covered in this tutorial.

PlanB, a user on Twitter, is the brains behind the Bitcoin Stock-to-Flow methodology. Notwithstanding their enigmatic identity, they represent themselves as a highly qualified institutional investor with Dutch roots who has experience in both legal and quantitative finance.

PlanB modified the traditional Stock-to-Flow model for the digital age and used it to forecast the price of bitcoin (BTC). In the brief history of Bitcoin, the S2F’s forecasts have proven to be correct several times, making PlanB’s Stock-to-Flow Model a well-liked tool among investors.

An economic model called Stock-to-Flow (S2F) evaluates the connection between the supply (current stock) and the flow of a commodity (annual production or supply growth). To determine how scarce a commodity is, the stock-to-flow ratio, which is computed by dividing the stock by the flow, is utilized.

Originally created for precious metals like gold and silver, the Stock-to-Flow concept has now been used for various assets, including Bitcoin.

The Stock-to-Flow model evaluates Bitcoin’s current supply in relation to its yearly output, which includes the new bitcoins produced through mining.

Let’s look at the stock-to-flow of gold to understand this better. There are 197,576 tonnes of gold in the stock, and 3,000 tonnes are added annually. The result of this computation is a Stock-to-Flow ratio of 65.85, which indicates that it would need 66 years of mining to double the quantity of gold that is now in use. As compared to silver, which has a Stock-to-Flow ratio of 22, this demonstrates how uncommon gold is. This explains why gold costs more than silver ($23 per ounce), whereas gold costs $1,914 per ounce.

Similar calculations may be made for the Stock-to-Flow of Bitcoin as of January 31, 2023. A total of 19.28 million bitcoins are in circulation, and only roughly 385,000 are produced annually.

Because we can anticipate future prices and compute the actual supply of bitcoin, we can calculate its Stock-to-Flow and make better investing judgments.

Understanding Bitcoin’s worth and price depends heavily on its rarity, which is closely related to the Stock-to-Flow concept.

There will only ever be 21 million bitcoins generated, hence their supply is limited. Currency is in short supply, which drives up its price together with rising demand for it.

The incidence of the halving represents one significant facet of Bitcoin’s rarity. The pace at which miners create new bitcoins is halved every four years. Miners received 50 bitcoins for every block when Bitcoin was originally established. In 2012, it was decreased to 25 bitcoin, and then again in 2016, to 12.5 bitcoin. The payment for mining a fresh block as of May 2020 is 6.25 bitcoin.

The stock-to-flow ratio of bitcoin will continue to rise as long as this pattern of decreasing the inflow of new coins into the market persists.

In the future, there won’t be much additional bitcoin coming onto the market, therefore demand will be the only factor affecting price. Positive forecasts about the price of bitcoin in the future have been made in light of this circumstance.

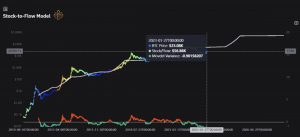

Some investors use the Bitcoin Stock-to-Flow chart to evaluate the market’s current position since it gives a visual depiction of the Stock-to-Flow ratio over time. The graph displays both the historical and anticipated Stock-to-Flow ratios for bitcoin over time.

The Bitcoin Stock-to-Flow Model has advantages and disadvantages, just like any other economic model. Following are some of the model’s benefits and drawbacks:

gives a framework for comprehending how, in the instance of Bitcoin, scarcity, value, and price are related.

outlines a clear and easy way for determining the market’s present status using scarcity.

gives a long-term viewpoint: For investors wishing to make long-term investment decisions, the Stock-to-Flow Model is a useful tool since it takes into consideration the long-term supply and demand dynamics of Bitcoin.

Restricted scope: Other variables that may affect the price of bitcoin, including demand, market sentiment, legislative changes, global economic circumstances, technical breakthroughs, and competition from other cryptocurrencies, that are not taken into consideration by the Stock-to-Flow Model.

only historical data Although the Stock-to-Flow model has historically been correct, it is only based on historical data and does not take into consideration unforeseen events that could have an influence on the price of bitcoin in the future.

The short answer is that you could trade bitcoin using the Bitcoin Stock-to-Flow Model.

Traders and investors might decide whether to purchase or sell bitcoin by comprehending the Stock-to-Flow ratio and the market’s past tendencies.

The Bitcoin Stock-to-Flow Model is one tool among many, but it must be remembered that it shouldn’t be depended upon alone. While making investment selections, it’s crucial to take into account the various elements that may have an influence on the price of bitcoin.

It’s also essential to proceed cautiously with any form of trading or investing and to fully research and comprehend the market before making any judgments. Although the Bitcoin Stock-to-Flow model might offer insightful information, it’s always necessary to take into account many information sources and to employ a variety of tools and methodologies while studying the market.

As a result, the Bitcoin Stock-to-Flow Model is a helpful tool for comprehending how the factors of rarity, value, and price relate to bitcoin. Traders and investors may make educated judgments regarding buying and selling bitcoin by taking into consideration the currency’s scarcity and previous market movements.

The model should be used in conjunction with other sources of data and analysis, but it’s important to remember that it is only one tool among many.